Pepperstone Review 2025 – Is It Still a Top-Tier Broker for Traders?

If you’re searching for a trustworthy forex broker, this Pepperstone Review 2025 will help you decide if it’s the right platform for your trading goals.

In a world full of flashy marketing and crowded platforms, Pepperstone has quietly built a reputation as one of the most reliable forex and CFD brokers globally. But does it still hold up in 2025?

Let’s explore everything — spreads, platforms, execution speed, regulations — and see if this broker deserves your trust.

1. What Is Pepperstone?

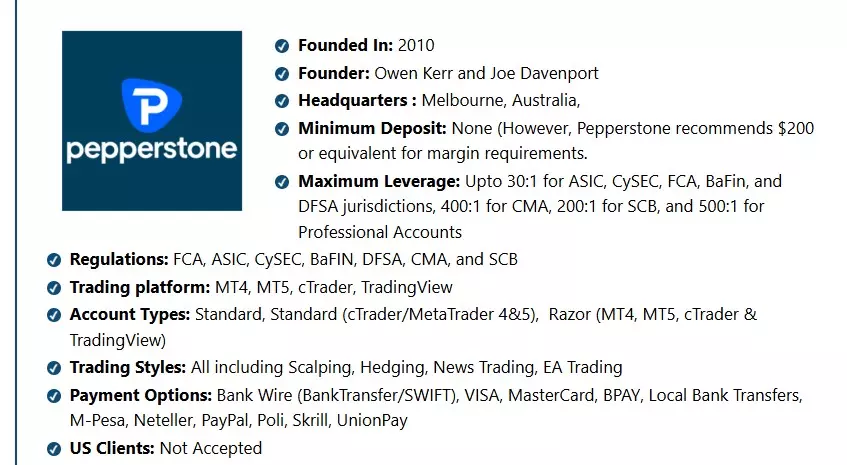

Founded in 2010 in Melbourne, Australia, this forex and CFD broker has grown into a globally recognized trading platform, boasting regulatory licenses in seven major jurisdictions, including:

🛡️ Regulatory Authorities Explained

1. ASIC – Australian Securities and Investments Commission (Australia)

Website: https://asic.gov.au

Role:

ASIC is the primary financial regulator in Australia. It oversees financial markets, securities, and financial services providers to ensure they operate honestly and transparently.

For brokers like Pepperstone, ASIC enforces:

- Client fund segregation (protecting trader capital)

- Financial reporting standards

- Risk disclosure requirements

→ This ensures traders are protected under strict Australian financial law.

2. FCA – Financial Conduct Authority (United Kingdom)

Website: https://fca.org.uk

Role:

The FCA is one of the world’s most respected financial regulators. It is known for rigorous enforcement and high investor protection standards.

Under FCA regulation, Pepperstone must:

- Maintain client money rules

- Offer negative balance protection

- Report capital adequacy and conduct audits

→ UK traders benefit from FSCS protection (up to £85,000 in compensation if a broker fails).

3. CySEC – Cyprus Securities and Exchange Commission (European Union)

Website: https://www.cysec.gov.cy

Role:

CySEC is a gateway to EU financial regulation under MiFID II. A CySEC license allows Pepperstone to offer services across the entire European Economic Area.

It ensures:

- Cross-border compliance with EU laws

- Investor compensation fund (up to €20,000)

- Leverage caps and marketing restrictions per ESMA guidelines

→ Ensures European retail traders are legally protected.

4. DFSA – Dubai Financial Services Authority (United Arab Emirates)

Website: https://www.dfsa.ae

Role:

DFSA regulates all financial services firms operating within the DIFC (Dubai International Financial Centre).

It is a strict, international-grade regulator focused on:

- Anti-money laundering compliance

- Ethical conduct

- Capital requirements

→ This gives traders in the Middle East access to a globally compliant platform.

5. BaFin – Bundesanstalt für Finanzdienstleistungsaufsicht (Germany)

Website: https://www.bafin.de

Role:

BaFin is Germany’s national financial regulator, known for its robust oversight and close alignment with the European Central Bank.

Under BaFin, Pepperstone is expected to:

- Maintain detailed audit trails

- Report internal controls

- Comply with anti-fraud and risk frameworks

→ German clients trade under one of the most disciplined regulatory structures in Europe.

6. CMA – Capital Markets Authority (Kenya)

Website: https://www.cma.or.ke

Role:

CMA is Kenya’s financial markets regulator, responsible for licensing and monitoring forex and CFD providers.

It focuses on:

- Local financial market development

- Ensuring brokers comply with fair conduct

- Consumer education and investor protection

→ Enables Pepperstone to legally serve the fast-growing African forex market, with safeguards.

📌 Summary Table:

| Regulator | Region | Strengths |

|---|---|---|

| ASIC | Australia | Client fund safety, strict audits |

| FCA | UK | Top-tier trust, FSCS coverage |

| CySEC | EU | EU-wide compliance (MiFID), compensation fund |

| DFSA | Dubai | AML focus, international best practices |

| BaFin | Germany | ECB-linked standards, transparency |

| CMA | Kenya | Regional access in Africa, fair trading conduct |

With more than a decade of experience, Pepperstone continues to attract both beginner and professional traders seeking tight spreads, fast execution, and platform flexibility.

🔎 Slogan Summary: Award-winning broker. MT5 & cTrader. Fast execution.

2. Pepperstone Highlights in 2025

After running multiple test accounts and comparing dozens of brokers, here are the key strengths of Pepperstone trading platform in 2025:

✅ Raw spreads as low as 0.0 pips on Razor accounts

✅ Lightning-fast execution, powered by Equinix servers

✅ Supports MT4, MT5, cTrader, and TradingView

✅ Ideal for scalpers, day traders, and EA/algo strategies

✅ No dealing desk (NDD) execution

✅ No deposit or withdrawal fees

✅ VPS hosting and FIX API for institutional traders

✅ Fully regulated in 7+ regions

✅ Great mobile and desktop experience

Let’s take a deeper look at Pepperstone pros and cons to help you evaluate if this broker fits your trading needs.

3. Pepperstone Pros and Cons

✅ Pros

- Regulated by tier-1 authorities (ASIC, FCA, CySEC, DFSA, BaFin)

- Ultra-low spreads from 0.0 pips (Razor)

- No deposit/withdrawal fees on most payment methods

- Offers TradingView, MT5, MT4, and cTrader

- Outstanding customer support (live chat, email, multilingual)

- VPS available for algorithmic traders

- Accepts crypto deposits (Bitcoin, Tether, etc.)

- Powerful copy trading integrations

❌ Cons

- Limited education tools for complete beginners

- No proprietary mobile app (only MT5/MT4/cTrader)

- Smaller range of individual stock CFDs vs. IG or XTB

- Limited passive investing options (no ETFs)

4. Is Pepperstone Safe?

Many new traders ask: Is Pepperstone safe? That’s a smart question — and the answer is a confident yes.

🔐 Why Pepperstone Is Safe:

- Licensed by tier-1 regulators like ASIC, FCA, and BaFin

- Client funds segregated in Tier-1 banks

- Negative balance protection for retail clients

- Complies with all capital requirements and transparency standards

- No history of major scandals or insolvency

When evaluating a broker in 2025, safety and regulation should be your top priority. And Pepperstone delivers across the board.

5. Platforms on the Pepperstone Trading Platform

Pepperstone doesn’t rely on an in-house system. Instead, it integrates world-class platforms that traders trust:

🧩 Supported Platforms:

- MetaTrader 4 (MT4): The classic choice for forex

- MetaTrader 5 (MT5): More instruments, better charts

- cTrader: Great for scalping and ECN-style trading

- TradingView: For chart lovers, mobile-first users, and social trading

Whether you’re using MT5 or cTrader, the Pepperstone trading platform suite is built for speed, flexibility, and ease of use.

Key Features:

- One-click trading

- Depth of Market (DoM)

- Smart order routing

- Fast execution (<30ms)

- Copy-trading via Myfxbook, DupliTrade, cTrader Copy

- FIX API & VPS for pros

Pepperstone’s infrastructure is hosted on Equinix data centers, ensuring >99.89% fill rate across all major instruments.

6. Pepperstone Spreads and Fees (2025)

Here’s a breakdown of spreads (data verified via pepperstone.com):

| Pair | Razor Spread (Raw) | Standard Spread |

|---|---|---|

| EUR/USD | 0.0–0.1 pips | 0.8–1.2 pips |

| GBP/USD | 0.2 pips | 1.0 pips |

| XAU/USD | 0.1–0.3 pips | 0.8–1.5 pips |

Compared to peers, spreads are excellent — especially on Razor accounts. No hidden fees. No markups.

Swap/rollover fees are average and clearly listed in your terminal.

7. Education: Where Pepperstone Falls Behind

Despite being a top-tier broker, Pepperstone’s learning center is limited for 2025 standards.

What’s missing?

- No progress-tracked courses

- No quizzes or certification

- No interactive modules

- No structured learning path for beginners

If you’re just starting out, you’ll likely need to supplement with YouTube, TradingView, or paid resources.

To compete with IG Academy or XTB Learn, Pepperstone needs to evolve this area.

8. Pepperstone Review 2025 — Star Ratings

| Category | Rating (out of 5) |

|---|---|

| Trust & Regulation | ⭐⭐⭐⭐⭐ (5.0) |

| Trading Platforms | ⭐⭐⭐⭐½ (4.5) |

| Spreads & Fees | ⭐⭐⭐⭐½ (4.5) |

| Education | ⭐⭐⭐ (3.0) |

| Support | ⭐⭐⭐⭐ (4.0) |

| Overall | ⭐⭐⭐⭐½ (4.4) |

9. Who Should Use Pepperstone?

This Pepperstone Review 2025 finds the broker ideal for:

- 🔁 Scalpers who need tight spreads

- ⚙️ EA & algo traders using MT5 or cTrader

- 🔄 Copy traders using DupliTrade, Myfxbook

- 🧠 Experienced traders wanting execution + reliability

- 🌐 Crypto-native traders funding with BTC, USDT

10. Final Verdict: Is Pepperstone Worth It?

If you’re looking for a clean, regulated, and fast trading experience, Pepperstone is one of the best choices in 2025.

It may not have flashy apps or influencer hype — but in terms of raw performance, reliability, and execution quality, it’s hard to beat.

Final Call: ✅ Recommended for serious traders. Beginners may need extra learning support.

Risk Disclaimer : Trading forex and CFDs involves significant risk of loss. Leverage can magnify both gains and losses. Consider whether you can afford to take the high risk of losing your money before trading. Seek independent advice if needed.

🔗 Further Reading (Outbound Links)

- Prop Firm Spread Comparison 2025 – Compare real spreads across top prop firms.

- The Funded Trader Review – Learn how gamification meets prop trading.

- MyFundedFX Review – Deep dive into payouts and rules.

- Exness Review 2025 – A crypto-friendly broker with instant withdrawals.