Prop Firm Getting Started Checklist

Prop trading has become one of the most attractive paths for traders who want access to larger capital without risking all of their own savings. Yet many beginners fail their first evaluation because they rush in, miss key rules, or trade without a structured plan. This prop firm checklist is designed to give you a clear roadmap. As a prop trading beginner guide, it covers account setup, platforms, risk, journaling, and payouts—everything you need for getting started with prop firms.

1) Understand Your Account Options

The first step in any prop firm checklist is choosing the right account type. Each model has different costs, rules, and expectations.

Challenge / Evaluation Accounts

Understand Your Account Options – Challenge / Evaluation Accounts

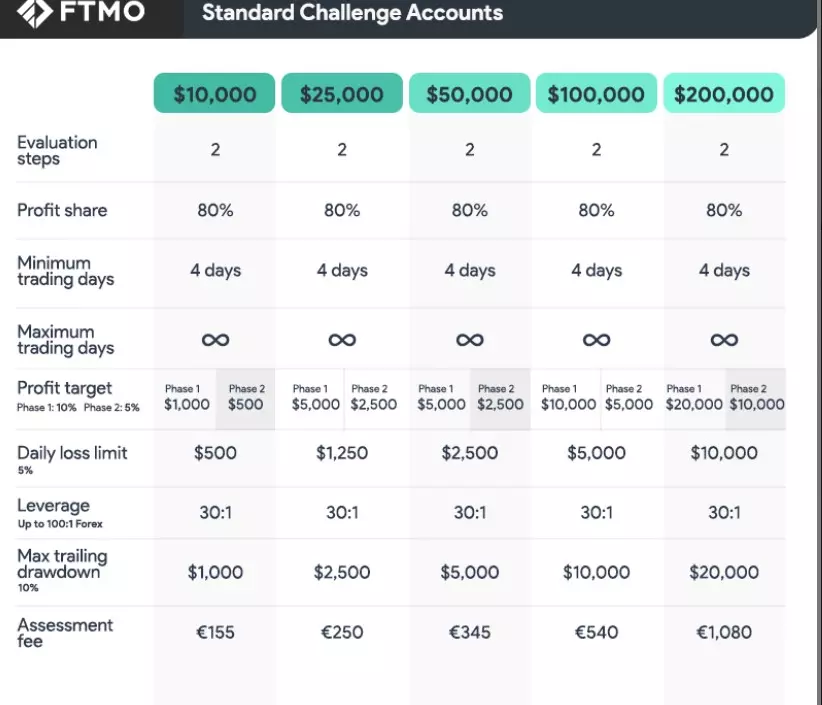

Challenge (or Evaluation) accounts are the most common way to start with a prop firm. You need to pass two phases by reaching profit targets while respecting strict risk rules.

- Phase 1: Hit 10% profit

- Phase 2: Hit 5% profit

- Minimum trading days: 4 per phase

- Risk rules:

- Daily loss limit = 5% of account size

- Max drawdown = 10% of account size

💡 Example:

On a $50,000 account, you must make $5,000 in Phase 1 and $2,500 in Phase 2.

- If in one day you lose more than $2,500, you fail instantly.

- But if you earn $1,000 per day for 5 days, you already pass Phase 1.

👉 These accounts are ideal for beginners who want a low-cost way to prove discipline and consistency before managing funded capital.

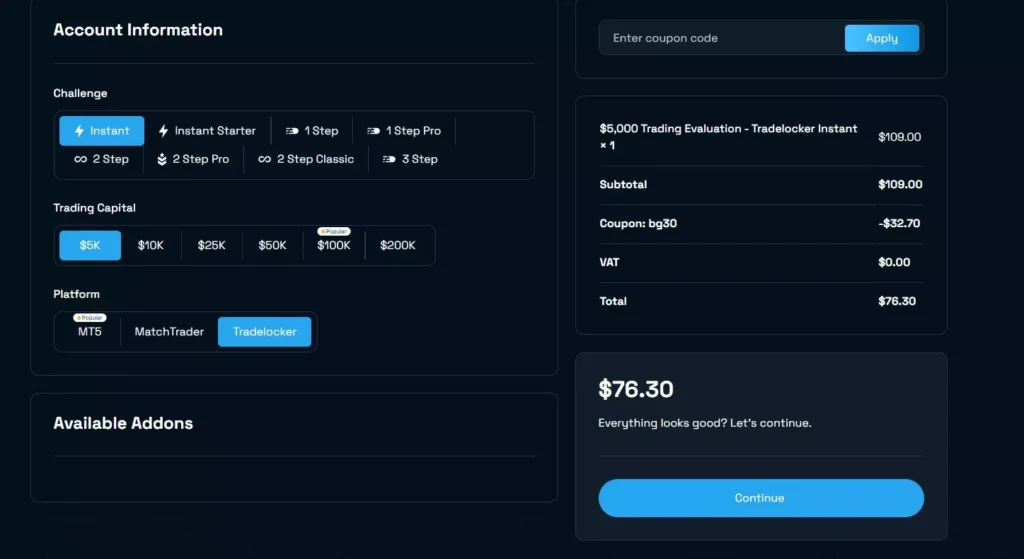

Instant Funding

Instant funding gives you immediate access to trading capital without passing multiple challenge phases. This means you can start trading a funded account right away.

- No Phase 1 & 2 challenges – you skip the evaluation stage.

- Higher fees – instant access comes at a premium cost.

- Rules still apply – you must respect daily loss limits, max drawdown, and other firm rules.

- Profit share – usually the same (e.g., 80%), but some firms may start lower until you scale up.

💡 Example:

- With a $5,000 instant account, you might pay $100+ upfront (instead of $70–80 for a challenge).

- You can trade immediately, but if your daily loss limit is $250 (5% of $5,000) and you lose more than that in one day, the account is terminated.

- If you grow the account by 10% ($500) while staying within the rules, you keep 80% of the profit (=$400).

👉 Instant funding is best for traders who want speed and real capital access but are confident they can manage risk consistently.

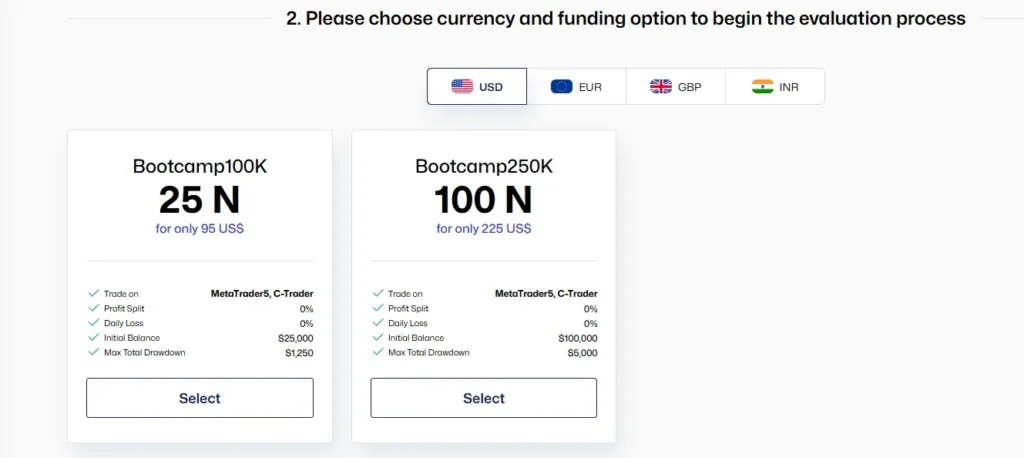

Bootcamp / Multi-Milestone Models

Bootcamp accounts guide traders through several structured phases (milestones). Instead of one or two big targets, you progress step by step, proving discipline and consistency over time.

- Multiple stages – each milestone has its own profit target and drawdown limits.

- Lower initial cost – often cheaper than large instant funding accounts.

- Focus on training – designed to build long-term trading habits, not just fast profits.

💡 Example:

- A $100K Bootcamp might start you with $25K, asking you to hit small goals (e.g., +$1,250 = 5%) before scaling to the next step.

- A $250K Bootcamp might start at $100K, with a max drawdown of $5,000. You must pass several rounds to unlock the full $250K account.

👉 Bootcamp models are ideal for beginners or those who want to treat the process like paid practice while slowly scaling into bigger funded capital.

👉 Tip: If you’re new, begin with a small challenge account and treat it as paid training.

2) Platform & Tools Setup

A prop trader’s workstation must be reliable. Without the right platform, you risk breaching rules accidentally.

- Install and update the platform your firm supports (MT4, MT5, or cTrader).

- Verify your login and server details before you start.

- Confirm whether EAs, copy trading, or news trading are allowed.

This step in the prop firm checklist ensures you’re technically ready before risking a single trade.

3) Know the Rules

Understanding firm rules is essential for getting started with prop firms.

- Daily Drawdown: Usually 5% of the account balance or equity.

- Maximum Overall Drawdown: Typically 10% before termination.

- Profit Targets: Often 8–10% for Phase 1 and 5% for Phase 2.

- Trading Restrictions: Some firms ban overnight or news trading.

- Minimum Trading Days: Often 5–10 before passing or requesting payout.

👉 Write these rules on a “Rule Card” to avoid costly mistakes.

4) Risk Management You Can Follow

Without strong risk management in prop firms, even skilled traders fail quickly. A simple, consistent plan is the key.

- Risk per trade: 0.5%–1% of account size.

- Daily stop: Pause trading if you hit −2% or two consecutive losses.

- Weekly cap: If down −4%, reduce position size for the rest of the week.

Drawdown Reference Table

| Account Size | Daily DD (5%) | Max Overall DD (10%) | Max Lot Size (1% risk)* |

|---|---|---|---|

| $25,000 | $1,250 | $2,500 | 2.5 lots |

| $50,000 | $2,500 | $5,000 | 5 lots |

| $100,000 | $5,000 | $10,000 | 10 lots |

👉 Example: On a $50,000 account, risking 1% per trade gives you five attempts before hitting the 5% daily drawdown.

5) Create a Trading Plan

A trading plan is another must-have in your prop firm checklist. It helps you avoid emotional decisions and stay consistent.

- Markets: Focus on liquid assets like EURUSD, Gold, or NAS100.

- Sessions: Choose specific hours (London or New York).

- Setups: Clearly define valid patterns such as breakouts or pullbacks.

- Entry & Exit: Document triggers, stop placement, and targets.

- No-Trade Conditions: Avoid trading during major news or with wide spreads.

By treating this like a rulebook, you’ll trade systematically rather than impulsively.

6) Journal & Performance Tracking

Keeping a prop trading journal is one of the most underrated habits. Memory is unreliable, but a journal is objective.

Record:

- Date, instrument, entry, stop, target, and result.

- Screenshots before and after.

- Emotions during the trade (fear, FOMO, revenge).

A weekly review reveals patterns—like whether losses often come outside your main trading session. This reflection turns experience into improvement, making the journal a powerful tool for growth.

7) First Payout & Money Plan

The last step in your prop firm checklist is planning your first withdrawal. Having a funded account payout plan ensures you enjoy your profits responsibly.

- Timing: Most firms allow payouts after 14–30 days.

- Profit Split: Ranges from 70% to 95%.

- Methods: Bank transfer, crypto, Wise, Skrill, PayPal.

Payout Example Table

| Profit Earned | 80% Split | 90% Split | 95% Split |

|---|---|---|---|

| $2,000 | $1,600 | $1,800 | $1,900 |

| $5,000 | $4,000 | $4,500 | $4,750 |

| $10,000 | $8,000 | $9,000 | $9,500 |

👉 Example: At 90% split, $5,000 profit equals a $4,500 payout. Many traders withdraw a portion for personal use and reinvest the rest for growth.

8) Final Checklist Before You Start

Here’s the short version of your prop firm checklist:

- Account: Choose the right model (Challenge, Instant, Bootcamp) and know the rules.

- Platform: Set up MT4/MT5/cTrader and confirm server + policies.

- Risk: Apply strict risk management in prop firms—never exceed limits.

- Journal: Maintain a prop trading journal to review trades.

- Payout: Have a funded account payout plan in place before trading.

Frequently Asked Questions (FAQ)

What’s a safe risk per trade for beginners?

Most traders keep risk at 0.5%–1% per trade. This keeps you within daily drawdown limits.

How soon can I withdraw my first payout?

Most firms allow payouts after 14–30 days, sometimes with a minimum trading day requirement.

Do prop firms allow EAs or copy trading?

It depends on the firm. Some allow EAs with conditions, while many restrict them during evaluation phases.

What happens if I break the drawdown rule?

Breaching daily or overall drawdown almost always results in account termination.

Can I hold trades overnight or during news?

Some firms prohibit it, others allow it. Always confirm in your program’s rulebook.

Conclusion

This prop trading beginner guide gives you a complete prop firm checklist for getting started with prop firms. By focusing on account setup, platforms, risk management in prop firms, journaling, and a funded account payout plan, you’ll trade like a professional from day one. Treat this as your roadmap—follow it consistently, and you’ll maximize your chances of long-term success.

Looking to explore more insights and guides? Check out our full library here: Prop Firm Knowledge