Top 3 Prop Trading Firms of 2025: A Detailed Review of The Trading Pit, Funding Pips, and Maven Trading

In the dynamic world of prop trading, three firms stand out for their unique offerings: The Trading Pit, Funding Pips, and Maven Trading. Each firm provides distinct features tailored to different types of traders. Whether you’re an experienced trader or just getting started, understanding these firms’ key advantages is crucial in selecting the one that best fits your trading goals. This article will examine the strengths of each firm and highlight what makes them unique.

Proprietary Firm Comparison

| Criteria | The Trading Pit | FundingPips | Maven Trading |

|---|---|---|---|

| Asset Types | FX, Stocks, Indices, Commodities, Crypto, Futures | FX, Stocks, Indices, Commodities, Crypto | FX, Stocks, Indices, Commodities, Crypto |

| Account Currency | USD, EUR | USD, EUR | USD, EUR |

| Refund Fee | Yes, if profit is achieved | Yes, if profit is achieved | No |

| Consistency Rule | No | No | No |

| Scaling | Yes, up to $5 million | Yes | Yes |

| Copy Trading | Yes | No | No |

| Country | Liechtenstein | UAE | Canada |

The Trading Pit: Flexible, Scalable, and Trusted by Traders

Overview:

The Trading Pit is an innovative futures prop firm that has rapidly built a strong reputation within the trading community. Known for its flexible funding plans, scalable account structures, and advanced trading technology, it stands out as an excellent option for traders who wish to grow their capital while utilizing cutting-edge tools and platforms.

Key Features and Differentiators:

- Scalable Funding Options:

The Trading Pit offers accounts ranging from $5,000 to $250,000, with the ability to scale progressively as traders meet performance targets. This scalability provides long-term potential for growth, catering to traders of all levels, from beginners to advanced. - Variety of Funding Plans:

The firm offers a wide range of funding programs, allowing traders to choose the plan that best fits their needs and risk profiles. This flexibility makes The Trading Pit an ideal choice for traders with different trading strategies. - Competitive Profit Splits:

With profit splits ranging from 50% to 80%, The Trading Pit ensures that traders retain a significant portion of their earnings. This higher-than-average profit share is a major advantage for those looking to maximize their trading potential. - Reliable and Timely Payouts:

Known for its weekly payouts, The Trading Pit ensures traders maintain a consistent cash flow, which is essential for sustaining a long-term trading career. This feature is a key selling point for many traders seeking reliable income. - Advanced Trading Technology:

The Trading Pit integrates state-of-the-art trading platforms, including MetaTrader 4, MetaTrader 5, TradingView, and Quantower. This broad platform support allows traders to execute their strategies efficiently and seamlessly, using the tools that best suit their trading style. - Wide Range of Markets:

Currently offering trading in CFDs and futures, The Trading Pit plans to expand into stocks and cryptocurrencies, providing traders with access to a growing range of markets. This expansion helps traders diversify their portfolios and explore new opportunities. - Support and Trustworthiness:

The Trading Pit is known for its responsive customer support, earning positive reviews on platforms like Trustpilot. Additionally, the firm holds a 9.43/10 trust score from Traders Union, a testament to its strong reputation for reliability and integrity in the prop trading industry.

Why Choose The Trading Pit?

The Trading Pit is an excellent choice for traders who value flexibility, scalability, and reliable payouts. Its competitive profit splits, advanced trading technology, and diverse funding options make it a standout firm for anyone looking to grow their trading accounts and capitalize on new opportunities in both traditional and emerging markets.

Funding Pips: Affordable Entry and Effortless Payouts

Overview:

FundingPips is a leading modern proprietary trading firm headquartered in Dubai. The company offers CFDs on commodities, energy, currencies, and indices within a simulated trading environment. Built by traders for traders, FundingPips provides unique benefits such as profit sharing of up to 100% and quick rewards. Additionally, it pioneered the concept of weekly rewards with its “Tuesday Payday,” setting it apart in the highly competitive trading industry.

Key Differentiators:

- Flexible Evaluation Models: Funding Pips offers multiple evaluation paths, including 1-step, 2-step, and the “Zero” program for instant funding, allowing traders to choose a method that aligns with their risk tolerance and trading strategy.

- High Profit Sharing: Traders can earn up to 80% or even 90% of their profits, providing a strong incentive to trade on the platform.

- Rapid & Flexible Payout Options: The firm offers flexible payout cycles, including weekly, bi-weekly, and monthly, with quick processing times and on-demand payout options.

- Wide Range of Trading Instruments: Traders gain access to a diverse range of trading assets, including Forex, Metals, Indices, Energy, and Crypto.

- Variety of Trading Platforms: Traders can use popular platforms like MetaTrader 5 (MT5), cTrader, and Match-Trader, offering flexibility for different trading preferences.

- Risk-Free Trading: Trades are conducted with simulated capital, meaning any losses on funded accounts are covered by Funding Pips, ensuring traders’ own funds are protected.

- No Minimum Trading Days: The lack of required minimum trading days provides flexibility, allowing traders to operate according to their own schedule.

- Transparency and Integrity: Funding Pips promotes clear operations, ensuring there are no hidden rules, providing traders with a trustworthy and open trading environment.

- Scalable Accounts: A structured scaling plan allows consistently profitable traders to increase their funded account sizes over time.

- Affordable Fees: The evaluation fees are designed to be competitive, making funded trading opportunities more accessible for a wide range of traders.

Why Choose Funding Pips?

Funding Pips is the perfect choice for traders who prioritize affordable entry, quick payouts, and minimal fees. Its simple structure and straightforward rules make it highly attractive for beginner and intermediate traders who wish to maximize profits with minimal upfront investment and enjoy the flexibility of no drawdown limits.

With a focus on accessibility and ease, Funding Pips allows traders to focus on their trading without the complexities of other more rigid prop firms.

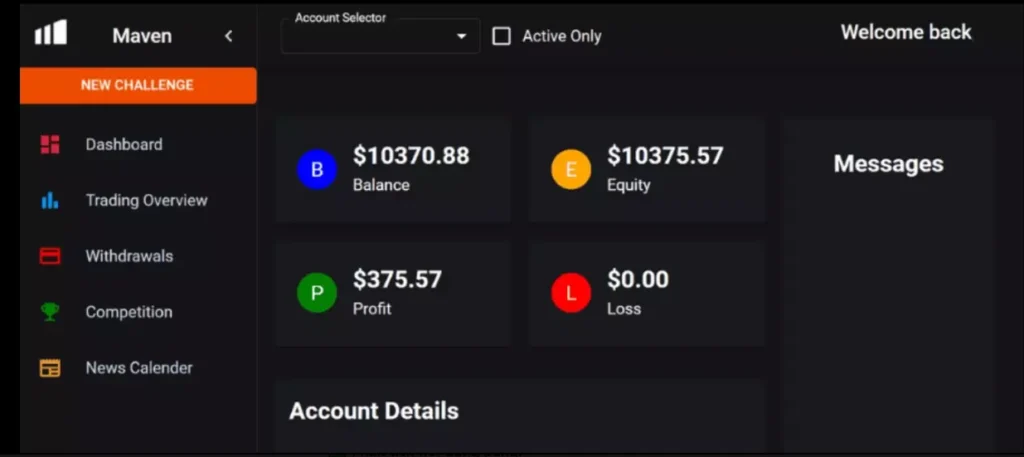

Maven Trading: Capital Funding with MetaTrader 5, cTrader & Match-Trader Support

Maven Trading is a rapidly growing proprietary trading firm based in Canada, founded in 2022. The firm stands out for its modern approach to funding, fast payouts, transparent processes, and support for multiple professional-grade trading platforms — including MetaTrader 5 (MT5), cTrader, and Match-Trader.

💼 Flexible Funding with Generous Profit Splits

Maven Trading offers funded accounts of up to $100,000, with profit splits ranging from 80% to 100% depending on trader performance. The firm provides both 1-step and 2-step evaluations, giving traders the freedom to choose a challenge structure that matches their risk appetite and trading style.

⚙️ Multi-Platform Trading Environment

What makes Maven especially appealing is its support for three industry-leading platforms:

- ✅ MetaTrader 5 (MT5) — Ideal for advanced traders, MT5 offers multi-asset capabilities, advanced charting, ultra-fast execution, and powerful strategy testing tools. Maven operates MT5 under its own license, ensuring stability and full feature support.

- ✅ cTrader — Known for its institutional-grade execution, deep market analysis, Level 2 pricing, and intuitive interface. cTrader is available on all major devices and supports more than 20 languages.

- ✅ Match-Trader — A browser-based, lightweight trading platform designed for seamless user experience and fast order execution.

By offering all three, Maven provides traders with maximum flexibility to trade on the platform they are most comfortable with — without compromise.

🌐 Wide Range of Markets

Traders can access multiple asset classes, including:

- Forex

- Indices

- Commodities

- Cryptocurrencies

This diversity enables strategic portfolio allocation and risk management across global markets.

💸 Fast Payouts & Trusted Service

Maven is known for payouts every 10 business days, with average processing times as fast as 58 minutes. Combined with award-winning customer support, Maven ensures traders enjoy both performance and peace of mind.

The firm maintains a strong 4.6/5 rating on Trustpilot, a testament to its reliability and trader satisfaction.

✅ Conclusion

If you’re looking for a proprietary trading firm that delivers on speed, transparency, technology, and trader empowerment, Maven Trading is a top-tier choice. With support for MetaTrader 5, cTrader, and Match-Trader, alongside scalable funding and flexible evaluations, Maven offers everything a serious trader needs to succeed in today’s competitive trading environment.

Which Prop Firm Is Right for You?

When it comes to choosing a prop firm, there is no one-size-fits-all solution. Here’s a quick recap of what each of these firms offers:

- The Trading Pit: Best for traders who want a scalable funding structure, reliable payouts, and advanced trading technology to support their growth.

- Funding Pips: Ideal for traders looking for affordable entry, quick payouts, and minimal fees to start trading without breaking the bank.

- Maven Trading: Perfect for experienced traders who value high profit splits and a tailored funding experience, along with access to professional-grade tools and resources.

Each of these firms has its own strengths, and the right choice depends on your trading goals and preferences. If you’re looking for affordability and simplicity, Funding Pips might be the best fit. For scalable funding and advanced technology, The Trading Pit is an excellent option. If you’re seeking high profit splits and a more personalized trading experience, Maven Trading is the firm for you.

| Criteria | The Trading Pit | Funding Pips | Maven Trading |

|---|---|---|---|

| Asset Types | FX, Stocks, Indices, Commodities, Crypto, Futures | FX, Stocks, Indices, Commodities, Crypto | FX, Stocks, Indices, Commodities, Crypto |

| Account Currency | USD, EUR | USD, EUR | USD, EUR |

| Refund Fee | Yes, if profit is achieved | Yes, if profit is achieved | No |

| Consistency Rule | No | No | No |

| Scaling | Yes, up to $5 million | Yes | Yes |

| Copy Trading | Yes | No | No |

| Country | UAE | UAE | Canada |

| Trading Platforms | MT4, MT5, TradingView, Quantower | MT5, cTrader, Match-Trader | MT5, cTrader, Match-Trader |

| Evaluation Types | 1-step, 2-step | 1-step, 2-step, Zero (instant funding) | 1-step, 2-step |

| Profit Split | 50% – 80% | 80% – 100% | 80% – 100% |

| Payout Frequency | Weekly | Weekly / Bi-weekly / Monthly | Every 10 business days (avg. 58 mins) |

| Trust Rating | 9.43/10 (Traders Union) | 4.7/5 (Trustpilot) | 4.6/5 (Trustpilot) |

Conclusion:

Choosing the right futures prop firm is essential for your trading success. By understanding the unique features and advantages of each firm, you can make an informed decision that aligns with your trading style, risk tolerance, and goals. Whether you’re a beginner looking for low-cost entry, or an experienced trader aiming for high profits and tailored plans, The Trading Pit, Funding Pips, and Maven Trading all offer valuable opportunities for traders to thrive in the futures market.

Disclaimer: Before selecting a prop firm, always conduct thorough research to ensure it aligns with your trading objectives and risk management strategy.

🧠 Frequently Asked Questions (FAQs)

❓What is a proprietary trading firm (prop firm)?

A proprietary trading firm (prop firm) is a company that provides traders with access to simulated or real capital to trade financial instruments such as forex, stocks, indices, and commodities. Traders can earn a share of the profits they generate — often between 70% to 100% — while the firm retains the rest.However, the firm does not absorb trading losses. Instead, it imposes strict risk management rules (like maximum drawdown limits and consistency rules) to protect its capital. If a trader violates these rules, their access to the funded account is revoked, and the firm does not pay for any losses.This model allows skilled traders to grow their profits without risking personal capital, but it also requires them to trade responsibly within set guidelines..

❓Which prop firm offers the highest profit split?

Both Funding Pips and Maven Trading offer up to 100% profit split for top-performing traders, making them excellent choices for maximizing profitability.

❓What is the difference between 1-step, 2-step, and Zero evaluations?

1-step: One phase evaluation for faster access to funding.

2-step: A more structured process with two phases to verify performance and risk control.

Zero: (Funding Pips only) Instant funding without any evaluation required.

❓Which firm is best for beginners?

Funding Pips is ideal for beginners due to its low fees, fast payouts, flexible rules, and instant funding options.

❓Do these firms support MetaTrader 4 (MT4)?

Only The Trading Pit supports MT4. The other two firms — Funding Pips and Maven Trading — support MT5, cTrader, and Match-Trader.

❓What trading platforms are supported?

The Trading Pit: MT4, MT5, TradingView, Quantower

Funding Pips: MT5, cTrader, Match-Trader

Maven Trading: MT5, cTrader, Match-Trader

❓How often are payouts processed?

The Trading Pit: Weekly

Funding Pips: Weekly / Bi-weekly / Monthly (on-demand)

Maven Trading: Every 10 business days (average: 58 minutes)

❓Do any of these firms offer copy trading?

Only The Trading Pit offers copy trading. The others currently do not support this feature.

❓Which firm has the highest scalability?

The Trading Pit supports account scaling up to $5 million, making it ideal for long-term growth.

❓Are there consistency rules or minimum trading days?

None of the three firms enforce consistency rules or required trading days. You can trade according to your own pace and schedule.

❓Which firm has the best trust rating?

The Trading Pit: 9.43/10 (Traders Union)

Funding Pips: 4.7/5 (Trustpilot)

Maven Trading: 4.6/5 (Trustpilot)

❓How do I choose the right prop firm for my trading goals?

Funding Pips is best for beginners and low-cost access.

The Trading Pit is great for scalability and tech-focused traders.

Maven Trading is perfect for those seeking high profit splits and flexible platform access.

📚 Read More

- For Traders Review 2025 – A detailed analysis of platform performance, features, and user experience.

- Prop Firm Fees, Discounts & Refunds – Explore the latest pricing structures and refund policies of leading prop firms.

- The Trading Pit vs Blue Guardian – Compare two top proprietary trading firms and find out which suits your trading style best.

- Forex Brokers and Trading Tips – Learn essential tips to choose reliable brokers and improve your trading results.