2025 YouHodler Full Analysis: Security, Lending, Earn Rates & Real User Experience

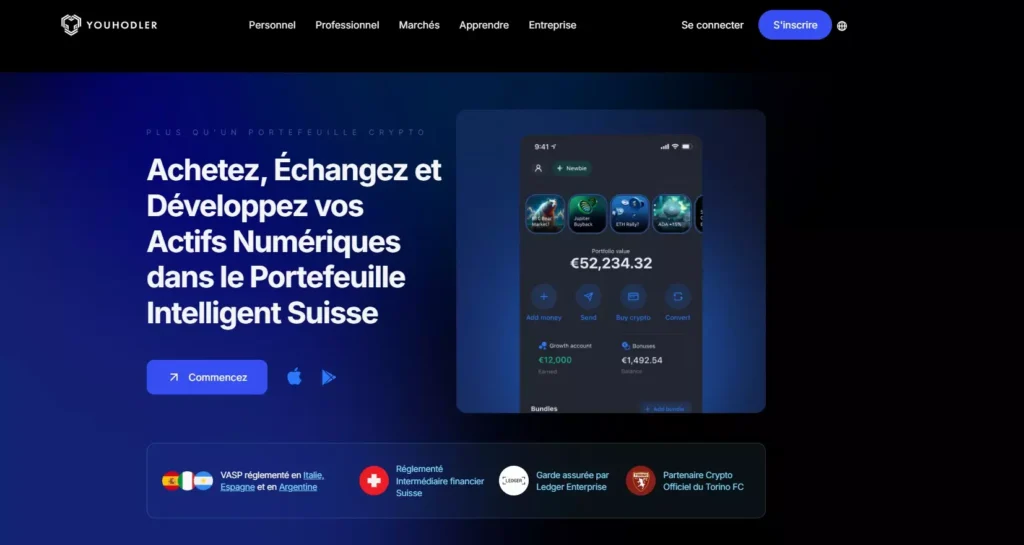

In 2025, YouHodler remains one of the standout digital asset service platforms in Europe, offering crypto-backed loans, interest-earning accounts, and simple asset swap features. The company operates from Switzerland and Cyprus, follows standard KYC/AML procedures, and implements multi-layer security measures such as 2FA and secure asset storage. This review will give you a clear, balanced overview of YouHodler’s strengths, limitations, and key features so you can decide whether the platform is the right fit for your needs.

Overview

YouHodler is a digital asset service platform launched in 2018, operating mainly in Europe with offices in Cyprus and Switzerland. The platform offers a range of crypto-focused financial services, including:

- Crypto-backed loans

- Interest-earning crypto accounts (Earn)

- Quick swaps between crypto and fiat

- Advanced tools like Multi HODL and Turbocharge for users who want higher market exposure

According to reviews from Webopedia and 99Bitcoins, YouHodler is considered a user-friendly CeFi platform that works well for both beginners and more experienced users.

The company’s core mission is to bridge the gap between traditional finance and digital assets, rather than positioning itself as a fully “bankless” or purely DeFi-style platform. YouHodler focuses on practical financial services, transparent operations, and compliance with European KYC/AML standards.

Licensing, Security & Trust

Licensing & Regulatory Status

According to Webopedia, YouHodler operates through legally registered entities in Switzerland and Cyprus, and is also registered to provide services in Italy. The company does not position itself as a traditional exchange or a bank. Instead, YouHodler defines itself as a FinTech platform offering crypto-backed financial services, built to bridge digital assets with practical, regulated financial tools.

YouHodler follows European-standard KYC/AML procedures, and its corporate information, operating entities, and registered business details are publicly available on its official pages. This aligns with the compliance expectations for digital-asset service providers in 2025.

Security & Custody

According to 99Bitcoins, YouHodler uses Ledger Vault, a well-known institutional-grade custody solution, to secure and manage user assets. Through Ledger’s insurance program, the platform benefits from coverage of up to approximately USD 150 million, protecting against specific risks such as private-key theft or internal fraud.

These measures place YouHodler among the more security-focused CeFi platforms in the market, particularly for users seeking simple, non-trading-intensive financial services.

Transparency & Operational Clarity

P2PEmpire notes that, while YouHodler is transparent about its business registration and custody partners, the platform does not publish full financial metrics such as loan-book size or non-performing loan ratios. This means users cannot independently assess internal risk levels with the same depth expected from a bank or publicly traded institution.

Even so, YouHodler does not promote unrealistic guarantees. The platform avoids vague promises, publishes clear terms for interest accounts, and emphasizes that all crypto-related products carry risk — consistent with responsible CeFi practices in 2025.

Fees, Support & Limitations

YouHodler performs well in terms of usability. The platform’s interface is clean, intuitive, and generally easy for beginners to navigate. It also supports several major fiat currencies—such as EUR, USD, GBP, and CHF—and provides multiple deposit and withdrawal options, giving users flexibility when managing their funds.

On the downside, withdrawal fees can be relatively high, especially for fiat transfers, and the final cost may vary depending on the user’s country and the payment method chosen. Crypto withdrawal fees also differ from asset to asset, which can make overall costs inconsistent. In addition, the number of supported coins and advanced trading features is more limited compared with specialised exchanges. YouHodler offers a modest list of around fifty crypto assets and does not provide futures, options, or other complex trading products.

Customer support is another area with mixed feedback. Some users report long KYC verification times or delays in withdrawals when additional checks are required. In certain cases, processing may take several days, and re-verification can extend these waiting periods even further. These are points that prospective users should keep in mind when considering the platform.

Key Strengths & Potential Risks

Strengths

YouHodler offers a compelling set of advantages for users who want to hold their crypto while still putting it to productive use. The platform makes it easy to earn passive income through transparent interest accounts or access liquidity via crypto-backed loans without selling assets. This makes YouHodler especially attractive for long-term holders during positive market conditions.

In addition to the basics, YouHodler includes unique value-added tools such as Multi HODL and Turbocharge. These features give users controlled exposure to market volatility, offering more strategic possibilities than simple CeFi savings products. Another key advantage is the platform’s operational stability: since launching in 2018, YouHodler has remained active across multiple market cycles, helping it build a relatively strong and consistent reputation in the CeFi space.

Risks & Limitations

Despite its strengths, some features involve significant risk—particularly leverage-style products like Multi HODL. Users who are unfamiliar with how these tools work may experience losses larger than expected. And although YouHodler is registered in Switzerland, Cyprus, and Italy, this regulatory presence does not provide protections equivalent to traditional banks. Crypto products inherently carry higher risk, and users should be aware of the volatility involved.

Withdrawal fees and limits can also be restrictive. Fiat withdrawals may be costly depending on the region and method, and crypto fees vary across assets, which may be inconvenient for users who need high liquidity or fast settlement. Additionally, some regions have service limitations, and certain users report slower KYC verification or delayed withdrawals when extra checks are required. If you promote YouHodler via an affiliate link, it is important to clearly disclose the relationship to remain compliant with advertising standards.

Conclusion: Is YouHodler Worth Using?

Strong Fit for Long-Term Holders

YouHodler is particularly well-suited for users who want to hold their crypto for the long run while still generating value from it. The platform’s transparent interest accounts allow long-term investors to earn stable passive income without taking on complicated strategies, making it an appealing alternative to simply storing assets in a wallet.

Useful for Those Seeking Liquidity Without Selling Crypto

Another clear advantage is YouHodler’s ability to provide liquidity through crypto-backed loans. This is especially beneficial for users who believe in the future growth of their assets and prefer not to sell during favorable market conditions. By borrowing against their crypto, they can access funds while keeping their investment positions intact.

Ideal for Users Who Prefer Simplicity and Clarity

With its easy-to-use interface, consistent user experience, and straightforward CeFi design, YouHodler caters well to people who want practical financial tools rather than sophisticated trading products. The platform focuses on clear, simple services—such as earning, borrowing, and swapping assets—making it accessible even for beginners.

Not Suited for Advanced Traders

Despite its strengths, YouHodler may not be the right fit for users looking for professional trading environments. Those who need advanced tools like futures, options, margin trading, or a wide range of trading pairs will likely find the platform too limited, as it does not aim to compete with full-scale exchanges.

Overall Assessment

Taken together, these factors make YouHodler a strong choice for everyday users who want reliable ways to earn interest, borrow against their assets, and manage their crypto with confidence. While it may lack the complexity required by professional traders, it excels in delivering clarity, stability, and practical value to the majority of crypto users.

FAQ – YouHodler (2025)

1. Is YouHodler a cryptocurrency exchange?

No, YouHodler is not a traditional crypto exchange; it is a CeFi platform focused on lending, earning interest, and simple asset swaps. However, this specialization allows the platform to deliver a clean, streamlined experience without the complexity that full trading exchanges often bring.

2. Is YouHodler safe to use?

YouHodler uses Ledger Vault for institutional-grade custody and is covered by insurance up to approximately $150 million. While this does not offer the same protection as a fully regulated bank, it still provides a higher level of security compared to many other CeFi platforms.

3. How does the Earn account work?

You can deposit crypto or stablecoins to receive transparent, fixed interest paid weekly. Some users may prefer DeFi for potentially higher yields, but YouHodler offers simplicity and lower technical risk, making it more accessible to general users.

4. How do crypto-backed loans on YouHodler work?

You deposit crypto as collateral and receive a loan in fiat or stablecoin without selling your assets. Loan interest may be higher than traditional bank loans, but users gain the benefit of keeping their market exposure instead of liquidating their holdings.

5. Does YouHodler support advanced trading tools like futures or margin?

No, YouHodler does not offer futures, margin trading, or advanced charting tools. However, this limitation also reduces risk for beginners and keeps the platform focused on essential financial services rather than speculative trading.

6. Are withdrawal fees on YouHodler high?

Fiat withdrawal fees can be higher than average, and crypto withdrawal fees vary by asset. Nevertheless, many users accept these costs in exchange for the platform’s convenience, stability, and transparent financial products.

7. What is Multi HODL?

Multi HODL is a tool that lets users amplify their market exposure by using small, automated loans to increase position size. This carries leverage risk, but it offers a controlled alternative for users who want more market exposure without using traditional high-risk trading platforms.

8. How does Turbocharge work?

Turbocharge creates a chain of automated loans to expand your crypto position. While this feature involves higher market risk, it remains optional and is designed for users who understand leverage and want to experiment with more dynamic strategies.

9. Is YouHodler suitable for beginners?

Yes. Its clean interface, straightforward features, and transparent operations make it friendly for newcomers. Even though it lacks advanced trading tools, this simplicity is precisely what many new users appreciate.

10. Who is YouHodler most suitable for?

YouHodler is ideal for long-term holders, users seeking stable passive income, and those who want to borrow without selling their crypto. It may not satisfy professional traders, but it excels at providing practical, low-complexity financial services for everyday crypto users.