What Is Blue Guardian Prop Firm? History, Funding Limits & Profit Split

Blue Guardian Prop Firm Review: Blue Guardian is a UAE-based proprietary trading firm (formerly Blue Guardian Capital) launched in September 2021 and rebranded in 2023 with a new website. Its founders have worked in financial markets since 2019. In this review, we explain how the program works, whether Blue Guardian is legit, and what traders can expect from its funding model.

Traders can manage up to $400,000 through fee-based accounts, with scaling potential up to $2,000,000. Successful funded traders receive up to an 85% profit split, making Blue Guardian a competitive option among prop firms for those seeking clear rules, growth paths, and reliable payouts.

- Location: United Arab Emirates

- Launched: September 2021 | Rebrand: 2023

- Max Account: $400K (fee-based) • Scaling: up to $2M

- Payouts: Up to 85% profit split

Blue Guardian Capital – Founders and Evolution

Blue Guardian Capital was co-founded by Sean Bainton (CEO) and Eric Gairns (CCO), both professional traders with deep expertise in the forex industry. The firm began in 2019 as a forex signal service and educational hub before transitioning into a proprietary trading firm.

Early on, the founders focused on building systems powered by machine learning and quantitative analysis to help traders manage risk and develop consistency. They also engaged with technology providers in the forex sector to validate their strategies and demonstrate results to a wider audience.

By 2021, the company shifted fully into the prop firm model, introducing structured evaluation programs to attract traders worldwide. This move opened the door for aspiring traders to access institutional capital while following defined trading rules.

To strengthen its presence in a competitive industry, Blue Guardian later introduced a modernized dashboard with integrated tools designed to improve user experience and support funded traders more effectively.

Blue Guardian Prop Firm – Pros and Cons

Blue Guardian has grown quickly in the prop firm industry thanks to its competitive payout structure and trader-friendly rules. Below you’ll find an updated overview of its key advantages and a few limitations to be aware of before you join.

✅ Advantages of Blue Guardian

- High profit split: funded traders keep up to 85% of their profits, with optional add-ons that can raise this to 90%.

- Refund policy: evaluation fees are fully refunded once a trader reaches their 4th profit split payout.

- Flexible trading rules: overnight and weekend trading are allowed, as well as news trading.

- Risk management tools: the unique Guardian Protector helps traders manage drawdowns more effectively.

- Regular payouts: profits are typically paid every two weeks, ensuring fast access to earnings.

- Supports automation: Expert Advisors (EAs) and copy trading are permitted, giving traders more strategy options.

❌ Limitations of Blue Guardian

- No official free trial account is available at this time.

- Per the terms of service, the firm can disable account access in case of rule violations, which some traders may view as restrictive.

Bottom line: Blue Guardian offers strong funding opportunities, high profit splits, and flexible rules compared to many competitors. However, traders should be aware of its strict compliance policies and the lack of a demo trial before joining.

Blue Guardian Review – Can You Trust This Prop Firm?

When evaluating Blue Guardian Prop Firm, traders will quickly notice mixed opinions across review sites, forums, and trading groups. On Prop Firm Match, Blue Guardian holds a 4.1/5 rating based on 144 reviews, reflecting both satisfied clients and some critical feedback. The firm was founded in June 2021 and has been in operation for over four years, with Sean Bainton listed as CEO. Blue Guardian uses Match Trader and TradeLocker platforms and partners with institutional liquidity providers to ensure execution quality.

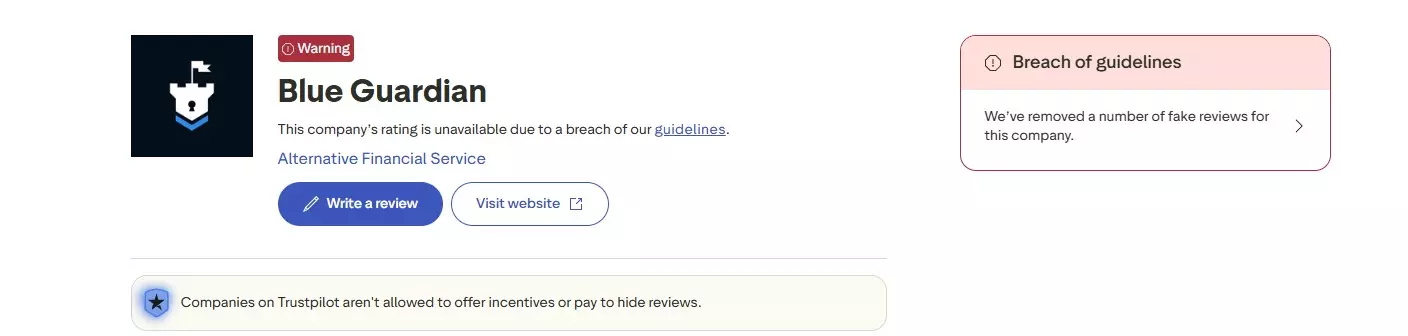

Despite the positive aspects, a notable concern is that Trustpilot flagged Blue Guardian for breaching its guidelines, resulting in its rating being hidden. While this does not automatically disqualify the firm, it does highlight the need for careful due diligence. Traders should weigh community feedback, payout history, and platform transparency before committing funds.

What to check before you join:

- Latest payout proofs, processing speed, and payment methods available to traders.

- Exact challenge rules, including drawdown limits, profit targets, news trading, and EA usage.

- Support quality and responsiveness from Blue Guardian’s team.

- Scaling opportunities up to $2,000,000 versus the risk controls applied.

- Discount offers (up to 30.5% OFF) and refund conditions for evaluation fees.

Conclusion: While Blue Guardian is a well-known name in the prop firm space with attractive profit splits and discount offers, the Trustpilot warning for guideline breaches should not be overlooked. This signals that traders must be extra cautious, verifying payout histories, community feedback, and real trading experiences before committing to a challenge. Reputation matters, and due diligence is essential when evaluating any funding program.

Instant Funding vs. 2-Step Challenge – Which Path Fits You Best?

Choosing between Instant Funding and the 2-Step Challenge at Blue Guardian is about more than preference. Each path comes with distinct rules, risk exposure, and payout conditions. Here’s a simplified breakdown:

⚡ Instant Funding

- Immediate access to a live account, no evaluation required.

- Profit targets: 8% (Phase 1), 5% (Phase 2).

- Faster payouts (sometimes weekly/daily).

- Stricter consistency rules & tighter drawdown limits.

- Higher pressure and greater risk from day one.

📈 2-Step Challenge

- Structured evaluation with 2 profit targets (8% + 5%).

- Lower entry risk, more time to adjust strategies.

- Bi-weekly payouts once funded.

- Gradual path suited for steady long-term growth.

- Less pressure, better for intermediate/new traders.

🔑 Key Differences

- Payouts: Instant = faster, Challenge = stable bi-weekly.

- Risk: Instant = higher exposure, Challenge = lower risk.

- Pressure: Instant = stressful from start, Challenge = smoother learning curve.

- Best for: Instant suits seasoned pros; Challenge is ideal for most traders.

Bottom line: If you want speed and can handle stress, Instant Funding may be right for you. If you prefer structure and long-term growth, the 2-Step Challenge is the safer route.

Who Can Join Blue Guardian? Eligibility and Restricted Countries

Blue Guardian is not suitable for everyone. The prop firm applies specific rules and regional restrictions, meaning only certain traders can access its programs. Before joining, it’s important to understand who the firm is designed for and which countries are restricted.

✅ Who Blue Guardian Is Best For

- Experienced forex traders who can manage risk and trade consistently under strict rules.

- Scalpers and swing traders who want flexibility to trade during news events, overnight, or weekends.

- Algo/EAs users since Blue Guardian allows Expert Advisors and copy trading systems.

- Ambitious traders seeking scaling opportunities up to $2,000,000 with profit splits up to 85%.

- Global traders who are not residents of restricted countries (see list below).

❌ Who It May Not Suit

- Beginners with no risk management plan.

- Traders who prefer a free trial account (Blue Guardian does not currently offer one).

- Residents of countries where Blue Guardian is restricted.

🌍 Restricted Countries

According to Blue Guardian’s official policy, traders from the following countries are not eligible to participate:

Note: This list may be updated by Blue Guardian depending on compliance and international regulations. Traders should always confirm directly on the official website before applying.

Conclusion, Advice & Risk Notice

Bottom line: Blue Guardian can be attractive for skilled traders thanks to competitive profit splits, scaling potential, and flexible rules (news/overnight/EAs). That said, remember two critical facts: funded accounts are simulated (not real-money brokerage accounts), and Blue Guardian has a Trustpilot warning (breach of guidelines). Treat this prop firm as a tool to prove discipline—not a shortcut to guaranteed income.

Practical Advice Before You Buy a Challenge

- Verify payouts: look for recent, verifiable payout proofs (transaction IDs/video reviews) from multiple independent sources.

- Read the rules twice: max drawdown, daily limits, news restrictions, EA/copy-trading rules, consistency, payout cadence, and refund conditions.

- Test support: open a ticket/live chat and judge response time and clarity before paying any fee.

- Choose the right track: pick the 2-Step Challenge if you value structure and lower pressure; consider Instant Funding only if you already trade profitably with strict risk control.

- Start small & scale: use conservative risk (e.g., 0.5–1% per setup), keep a trade journal, and scale only after consistent payouts.

- Check eligibility: confirm you are not in a restricted country and that your payment method/KYC is accepted.

Warnings & Disclaimers

- High risk: challenge fees can be lost quickly if you violate rules or underperform. Never borrow money to pay evaluation fees.

- Account termination: rule breaches may lead to access being disabled without refund—manage risk and read the terms carefully.

- Ratings ≠ reality: third-party stars/reviews (including Trustpilot) can be manipulated or incomplete—do your own due diligence.

- Not investment advice: prop programs are educational/simulated services; results are not guaranteed and vary by trader.

If you decide to proceed with Blue Guardian, invest only what you can afford to lose, document everything (KYC, trades, payouts), and let data—not hype—drive your decisions.

Join Blue Guardian on the Official Site – Claim 30% OFF

Start your challenge with an exclusive discount. Limited-time offer—terms may apply.

Join the Challenge – Get 30% OFFExplore more: Check out the top funding programs available for traders like you.