FP Markets Regulation: A Trusted Forex Broker Worldwide

FP Markets is a globally recognized trusted forex broker, established in Australia in 2005. With years of proven experience, FP Markets continues to provide traders with a secure and transparent trading environment backed by multiple international regulations.

In Australia, FP Markets operates under the supervision of the Australian Securities and Investments Commission (ASIC), ensuring strong investor protection and strict compliance with financial standards. For European traders, the broker is licensed by the Cyprus Securities and Exchange Commission (CySEC), while in South Africa, it is regulated by the Financial Sector Conduct Authority (FSCA). Additionally, FP Markets is authorized by the Financial Services Authority (FSA) of Seychelles, making it a truly global brokerage firm.

Why This Broker Is a Reliable Choice

With over 40 industry awards for excellence in customer service and trading technology, FP Markets has built a solid reputation among both new and professional traders. Over the years, the broker has earned more than 50 honors in the forex and CFD trading industry, proving its dedication to innovation, transparency, and client satisfaction.

Since its founding in 2005, FP Markets has focused on delivering competitive trading conditions, including low spreads, fast order execution, and powerful trading platforms. Traders can choose between MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the world’s most popular trading platforms, to access a wide range of markets such as forex currency pairs (EUR/USD, AUD/USD, GBP/USD) and commodities.

Benefits for New and Professional Traders

FP Markets provides flexible trading conditions suitable for every level of experience. Beginners can start with a demo account to practice risk-free, while live accounts require a minimum deposit as low as $100. With the use of Expert Advisors (EAs), automated strategies, and advanced risk management tools, FP Markets ensures a professional trading experience for all clients.

By choosing a trusted broker, you gain the confidence of trading with an ASIC and CySEC regulated forex company that values transparency, security, and global recognition.

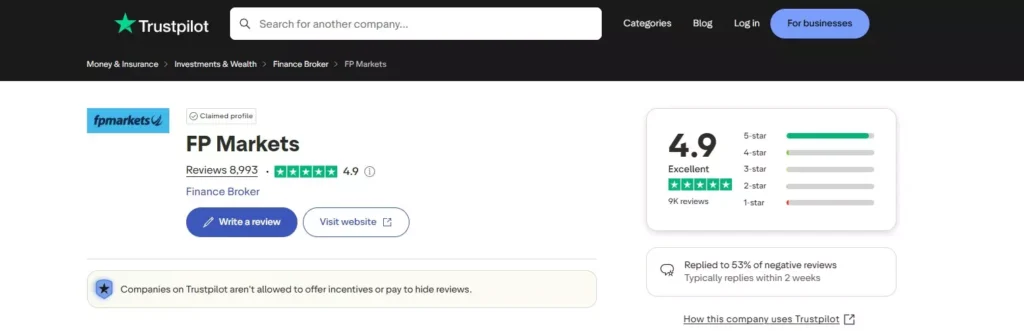

FP Markets: Trusted by Thousands with an Excellent 4.9 Rating on Trustpilot

FP Markets has an impressive rating of 4.9 out of 5 stars on Trustpilot, with nearly 9,000 reviews. This shows that many users are happy with their services. Most of the reviews, around 5,000 of them, are 5-star ratings, which highlights how much customers trust FP Markets.

The high rating is a clear sign of the platform’s reliability. Many forex traders who use this broker report positive experiences, and the feedback speaks volumes. Trustpilot is a trusted platform, and you don’t need to worry about fake reviews. Everything is transparent, so you can be confident in the reviews you read.

Overview of FP Markets

FP Markets stands out as a leading CFD broker (Contract for Difference), offering access to thousands of CFDs across forex, commodities, indices, cryptocurrencies, and stocks. The broker caters to different types of traders through various trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView, as well as offering VPS hosting for algorithmic traders.

| Pros | Cons |

|---|---|

| Low Trading Costs: Competitive spreads and commissions, especially for forex and crypto. The Raw Spreads account offers ultra-low spreads. | Lack of Proprietary Web Platform: No in-house web platform, relying on third-party platforms instead. |

| Diverse Range of Instruments: Access to over 10,000 CFDs across forex, stocks, ETFs, commodities, and cryptocurrencies. | Limited Availability of Real Shares for Investing: Focus on CFDs, which means no direct investment in real stocks or ETFs. |

| Multiple Trading Platforms: Offers MetaTrader, cTrader, TradingView, Iress, and Mottai, providing options for all types of traders. | Offshore Entity: Some offshore entities are unregulated, which could be concerning for traders seeking maximum regulatory protection. |

| Educational Resources: Comprehensive tutorials, platform guides, and webinars suitable for beginners. | |

| VPS Hosting: Low-latency execution and reliable trading for automated traders. |

Who Should Trade with FP Markets?

This trusted forex broker offers something for every type of trader. Here’s how it caters to different trading strategies:

- Beginners: FP Markets provides solid educational content, demo accounts, and beginner-friendly platforms like TradingView, making it an ideal option for newcomers.

- Scalpers: Thanks to low spreads and VPS hosting, FP Markets is a great choice for scalpers. Fast execution times and direct market access make it a solid platform for high-frequency trading.

- Day Traders: With access to multiple platforms and real-time trading data, FP Markets is an excellent choice for day traders who need quick order execution and a range of trading instruments.

- Automated Traders: The availability of cTrader and MetaTrader allows traders to implement automated strategies. Combined with VPS hosting, this creates an excellent environment for algorithmic trading.

FP Markets Trading Platforms

FP Markets supports a wide range of platforms, making it accessible for traders of all skill levels.

- MetaTrader 4 & 5

These are two of the most popular platforms for forex and CFD trading. They are feature-rich, offering tools for algorithmic trading, backtesting, and advanced charting. - cTrader

A great option for day traders and scalpers, cTrader offers an intuitive interface and deep market data (Level 2) that helps traders make informed decisions. - TradingView

Popular with social traders, TradingView offers advanced charting and social features that allow traders to share ideas and strategies in real-time. - Iress

Available to clients in Australia, Iress provides Direct Market Access (DMA), enabling traders to place orders directly in the market without intermediaries.

FP Markets Fees and Commissions

FP Markets is known for its competitive fees.

- Spreads: For major forex pairs, spreads are tighter than the industry average. For example, EUR/USD spreads are as low as 1.1 pips.

- Commissions: Raw Spreads accounts charge $3 per side, while Standard accounts have no commission, with costs incorporated into the spread.

- Swap Fees: Swap fees for holding positions overnight are typical within the industry.

Conclusion: Should You Trade with FP Markets?

FP Markets has a strong reputation in the industry, offering a competitive range of instruments, excellent trading platforms, and educational resources. Its low trading costs, high-quality research, and VPS hosting make it an excellent choice for active traders, especially scalpers and algorithmic traders.

However, potential investors looking for real shares or long-term investing opportunities may find FP Markets lacking in this area. Furthermore, the presence of offshore entities may be a concern for some traders.

Our Recommendation: FP Markets is a strong choice for active traders and those interested in CFDs. Beginners and more casual traders can also benefit from its educational resources, while experienced traders will appreciate the advanced platforms and tools available.

Register HereRisk Warning: CFDs are leveraged products and come with a high risk of losing money rapidly due to leverage. Please ensure you fully understand the risks involved before trading and seek independent advice if necessary.

Read More:

- Maven Prop Firm Spreads 2025 – A detailed review of Maven Prop Firm’s spreads and trading conditions.

- Pepperstone Review 2025 – Find out why Pepperstone is a top choice for traders in 2025.

- Exness Review 2025 – Learn about Exness’ offerings, fees, and performance in 2025.