Prop Firm Challenges: A Complete Guide for Traders in 2025

The forex and trading world is evolving fast, and one of the biggest opportunities for traders today is the prop firm challenge. Instead of risking thousands of dollars from personal savings, traders can now access firm-backed capital by proving their skills in a structured evaluation.

For anyone serious about stepping up into the professional trading arena, understanding how prop firm challenges work is the key first step.

What Is a Prop Firm Challenge?

A prop firm challenge is a structured assessment set by proprietary trading firms to evaluate a trader’s performance, risk management, and consistency. To qualify, traders must meet targets like:

- Achieving a specific profit goal

- Staying within maximum daily and overall drawdown limits

- Following all firm trading rules (e.g., news restrictions, stop-loss requirements, consistency rules)

Passing the challenge grants access to a funded trading account, often ranging from $10,000 to $500,000 or more, depending on the firm’s funding program.

👉 Learn more in our full guide: What Is a Prop Firm & Why Choose The Trading Pit

Why Are Prop Firm Challenges Popular in 2025?

The appeal of prop firms is simple:

- Capital access without personal risk – traders only pay a one-time challenge fee.

- High profit splits – many firms now offer up to 80–90% profit share.

- Professional environment – challenges enforce discipline and consistency.

- Global accessibility – traders from around the world can participate, subject to KYC and restricted country policies.

In 2025, more firms are competing to attract traders, introducing faster payouts, instant funding options, and transparent scaling plans.

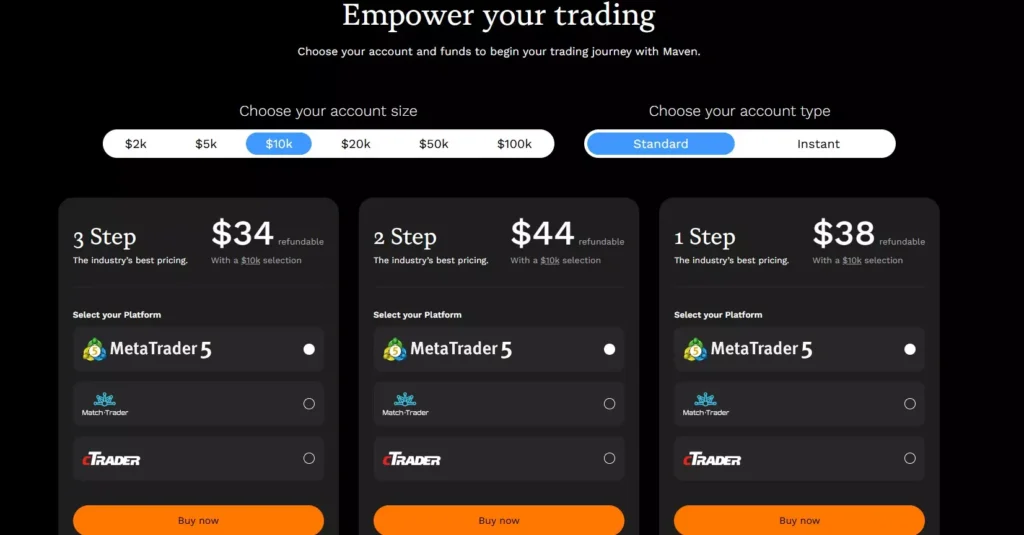

Types of Prop Firm Challenges

- Two-Step Challenge – the most common: a first evaluation (profit target + risk limits) and a verification stage to confirm consistency.

- One-Step Challenge – faster entry but usually with stricter rules.

- Three-Step Models – phased evaluations with more leniency, used by firms like MavenTrading.

- Instant Funding Programs – no challenge required; traders pay a higher fee and receive funded accounts immediately.

Each model has pros and cons depending on a trader’s style and risk tolerance.

Rules & Requirements to Pass

While every firm has different conditions, most include:

- Profit targets (e.g., 8–10% in phase one, 5% in phase two)

- Daily drawdown (e.g., 4–5%) and overall drawdown limits (e.g., 8–10%)

- Minimum trading days to prove consistency

- Restrictions on trading during high-impact news or using certain EAs

Failing to follow even one rule can mean restarting the challenge.

Pass Rates: Why Most Traders Fail

Industry reports show that only 5–10% of traders pass a prop firm challenge on the first try. The main reasons include:

- Over-leveraging positions

- Emotional decision-making under pressure

- Ignoring rules or misunderstanding drawdown limits

- Lack of a consistent, tested trading plan

Passing requires more than luck—it demands discipline and preparation.

How to Increase Your Chances of Success

- Study the rules carefully before starting.

- Backtest and demo trade under the same conditions.

- Control risk with strict stop-losses and proper position sizing.

- Focus on consistency rather than chasing big wins.

- Use trading journals to analyze mistakes and refine strategy.

What Happens After You Pass?

Once successful, traders gain access to funded accounts with profit-sharing opportunities. Many firms now:

- Pay out profits within 7–14 days

- Offer scaling plans to increase capital (e.g., from $100K to $400K)

- Provide payouts via bank transfer, crypto, or e-wallets

This model allows traders to grow without risking personal funds.

Choosing the Right Prop Firm

Not all firms are equal. When selecting a challenge, compare:

- Fees and refund policies

- Profit splits (80–90% is industry standard)

- Trading conditions (spreads, platforms, execution speed)

- Trustworthiness (track record, reviews, payout history)

For in-depth comparisons, see our updated Top Prop Firms Review.

Final Thoughts

Prop firm challenges are now one of the most exciting ways for retail traders to access professional trading capital. But the path is demanding: most fail because they underestimate the importance of risk management and consistency.

If you prepare properly, trade with discipline, and choose a reputable firm, a prop firm challenge can be the stepping stone to a serious trading career.

👉 Start your journey here: Top Funding Programs 2025

📌 FAQ – Prop Firm Challenges 2025

1. What is a prop firm challenge?

A prop firm challenge is an evaluation process where traders must prove their skills by following specific rules, such as profit targets and drawdown limits. Passing the challenge allows them to access funded trading accounts without risking personal capital.

2. How long does it take to pass a prop firm challenge?

The duration depends on the firm. Most two-step challenges take 30–60 days, while one-step challenges may allow faster evaluations. Some firms even offer instant funding programs with no challenge required.

3. What are the most common rules in prop firm challenges?

Typical rules include profit targets (usually 8–10%), maximum daily drawdown limits (3–5%), overall drawdown limits (8–10%), and minimum trading days. Each firm sets its own parameters.

4. Which type of challenge is easier to pass: one-step or two-step?

One-step challenges are faster but often come with stricter rules. Two-step challenges are more common, with slightly lower profit targets but require consistency across two phases.

5. Can beginners pass a prop firm challenge?

Yes, but beginners should practice on demo accounts first and develop a solid risk management strategy. Without preparation, traders may fail quickly due to over-leverage or emotional trading.

6. What happens after I pass a prop firm challenge?

Once approved, traders gain access to a funded account provided by the firm. They can trade with real capital and share profits (commonly 70–90%) while following the firm’s risk management rules.

7. Do prop firms really pay profits?

Legitimate prop firms do pay profits, usually through bank transfer, PayPal, or crypto. It’s important to choose reputable firms with transparent payout policies and trader reviews.

8. What are the main reasons traders fail prop firm challenges?

The biggest reasons are over-trading, ignoring risk management rules, chasing unrealistic profits, and emotional decision-making. Consistency is key to success.

9. Which prop firms offer instant funding in 2025?

In 2025, some firms like The Trading Pit and Funding Pips provide instant funding models where traders pay a higher fee to skip the challenge and trade immediately with real capital.

10. Are prop firm challenges worth it in 2025?

Yes, for disciplined traders, prop firm challenges are an affordable way to access significant trading capital. They eliminate personal financial risk and provide a pathway to professional-level trading.