What is a Prop Firm? How It Works & Why Traders Choose The Trading Pit (2025)

The global financial market isn’t limited to brokers or investment funds. There’s also a distinct model called a proprietary trading firm (prop firm). Unlike brokers, prop firms don’t earn from client trading fees. Instead, they deploy their own capital, allow skilled traders to trade that capital, and share the profits.

So, how do prop firms operate, how do they make money, and why choose The Trading Pit? Below is a clear breakdown to guide your decision.

What Is a Prop Firm?

A Prop Firm (Proprietary Trading Firm) is a trading company that uses its own capital to buy and sell assets such as stocks, forex, commodities, derivatives, or cryptocurrencies. The key advantage is that when you trade for a prop firm, you don’t need to deposit the full trading capital yourself. Instead, the firm provides the funds, and you only pay a challenge fee or a monthly subscription fee to gain access.

If you trade profitably, the profits are shared according to an agreed split (for example, 80% for you and 20% for the firm). If you incur losses, you won’t lose your own money beyond the initial fee you paid — because the trading capital belongs to the firm, not to you.

Key Differences Between a Prop Firm and a Broker:

- Prop Firm: Provides funding to traders, charges a participation or maintenance fee, and shares profits when the trader is profitable. The firm bears the capital risk.

- Broker: Requires you to deposit your own full capital, assumes no trading losses, and earns money from commissions or spreads.

💡 Example: If a prop firm funds you with a $50,000 account, you might pay a challenge fee of around $300. You buy Apple stock at $150 and sell at $160, making a $2,000 profit. With an 80/20 profit split, you keep $1,600 while the firm keeps $400.

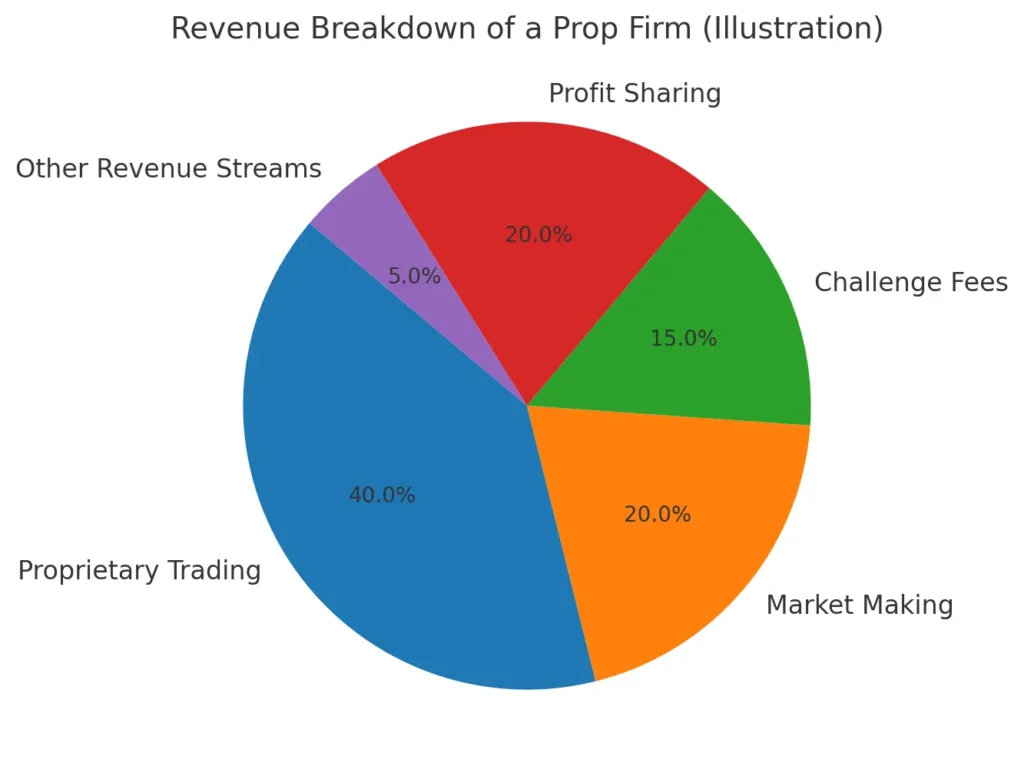

Key Revenue Streams of a Prop Firm

2.1. Proprietary Trading – The Most Important Revenue Source

This is the largest and core income stream for most prop firms. The company uses its own capital to execute various trading strategies, such as:

- High-Frequency Trading (HFT): Leveraging ultra-fast systems to place and cancel thousands of orders per second, profiting from very small price fluctuations.

- Arbitrage: Buying and selling the same asset in different markets to capture price differences.

- Quantitative Strategies: Using algorithms and big data to predict trends and execute trades automatically.

💡 Example: Hudson River Trading (HRT) — a well-known prop firm — generated $8 billion in net profit in 2024 by combining HFT, arbitrage, and long-term trading strategies.

2.2. Market Making – Supporting the Market While Earning Profits

Market makers ensure there is always sufficient liquidity in the market by continuously placing buy and sell orders. They earn from the bid–ask spread, the difference between the buying and selling price.

💡 Example: If a company buys a stock at $100 and sells it at $100.05 repeatedly in large volumes, the cumulative profit can be significant, even if the spread per trade is minimal.

2.3. Challenge Fees

This is a common revenue stream for prop firms targeting individual traders. The process typically works as follows:

- The trader pays a fee to join a challenge.

- If they meet the requirements (e.g., achieving 10% profit without exceeding the maximum drawdown), they receive a live funded account to trade.

- If they fail, the firm retains the entire fee.

💡 Example: A prop firm charges $300 for a challenge. If 1,000 traders participate and only 10% pass, the firm earns $270,000 from fees alone — not including profits from successful traders’ live accounts.

2.4. Profit Sharing

When traders generate profits, the firm and the trader split the earnings according to a pre-agreed ratio, often ranging from 50/50 to 80/20 in favor of the trader (depending on skill and experience).

💡 Example: If a trader earns $20,000 in a month with a 70/30 split, they receive $14,000, and the firm keeps $6,000.

2.5. Other Revenue Sources

Beyond these main channels, prop firms may also generate income from:

- Platform usage fees for proprietary trading systems.

- Training and coaching programs for traders.

- Selling or licensing proprietary analytics tools.

3. The Trading Pit – The Best Prop Firm Choice for Traders in 2025

If you are a serious trader, you’ve probably experienced the frustration of having a solid strategy and strong skills, yet lacking the capital to scale your trades. You might earn a few hundred dollars per month from a small account, but reaching thousands — or even tens of thousands — requires significantly more funding, which not everyone has readily available.

This is where a prop firm becomes the perfect launchpad. However, once you start exploring, you’ll quickly realize the market is full of funding companies — and not all of them are worth your time and effort. Some impose overly strict conditions, limit the time to complete challenges, or offer low profit splits that make it hard for traders to earn a sustainable living.

In this landscape, The Trading Pit stands out as a truly different choice. More than just a funding prop firm, The Trading Pit provides a flexible, transparent, and trader-friendly trading environment:

- Profit share up to 80% – allowing you to keep the majority of the profits you generate.

- No time limits for challenges – trade at your own pace without the pressure of short deadlines.

- Support for both CFDs & Futures – enabling diverse trading strategies, from short-term scalping to long-term investing.

- Global reputation and transparency – highly rated by the international trading community, with a clear process and professional support.

Conclusion – The Best Time to Start Is Now

The financial markets wait for no one. Every day you hesitate is a day of missed opportunities — and a day when other traders move ahead. If you already understand what is a prop firm, have solid trading skills, and a clear strategy, then securing larger capital to double — or even multiply by ten — your profit potential is something you should do right now.

In the prop firm 2025 landscape, The Trading Pit stands out for offering substantial trading capital, high profit splits, flexible challenge rules, and complete transparency. This combination provides traders with both the flexibility and control needed for long-term success.

🚀 Don’t let this opportunity pass you by.

👉 Register with The Trading Pit today and transform your trading skills into a sustainable source of income.

For a detailed The Trading Pit review, including how it works, its funding process, and the benefits it offers traders, visit the in-depth article on FXzilla. You’ll get a complete understanding of why The Trading Pit is a top choice for traders worldwide. Read it here: FXzilla – The Trading Pit: Funding Prop Firm 2025.

FAQs About Prop Firms & The Trading Pit

Whether you’re new to proprietary trading or searching for a detailed The Trading Pit review, this FAQ section will help you understand what is a prop firm, how it works, and why The Trading Pit is a preferred choice for traders in 2025.

1. What is a Prop Firm?

A Prop Firm (Proprietary Trading Firm) is a trading company that uses its own capital to buy and sell financial assets. Traders can trade with the firm’s funds and share profits when they are profitable.

2. Do I need to deposit my own capital to join a Prop Firm?

You don’t need to deposit the full trading capital. Instead, you only pay a challenge fee or a monthly maintenance fee. The trading capital belongs to the firm, and the risk of loss is borne by them.

3. How is The Trading Pit different from other Prop Firms?

The Trading Pit stands out with a profit share of up to 80%, no time limits for challenges, support for both CFDs and Futures, and a strong international reputation.

4. How much profit can I keep when trading with The Trading Pit?

You can keep up to 80% of your profits, while the remaining percentage goes to the firm to maintain capital and infrastructure.

5. If I lose trades, will I lose my own money?

You only lose the fee you paid to participate. The trading capital is provided by the prop firm, so you are not required to cover trading losses out of pocket (unless you violate the contract terms).