Is BlackBull Legit in 2025? Deep Liquidity, Raw Spreads, and Real ECN Power Explained

When traders search for deep liquidity, razor-thin spreads, and serious trading infrastructure, only a handful of brokers truly deliver. In this BlackBull Review 2025, we uncover whether this New Zealand-based broker still stands out in a market dominated by giants. More importantly, we ask the tough question: Is BlackBull legit, and is it worth your attention in 2025?

What Is BlackBull Markets and Why Are More Traders Choosing It in 2025?

BlackBull Markets is a New Zealand-based forex and CFD broker founded in 2014 in Auckland. Over the past decade, it has steadily built a reputation for reliability, speed, and transparency. By 2025, BlackBull Markets has become one of the most trusted names in the trading industry—especially among professional, algorithmic, and institutional traders.

What sets BlackBull apart from the crowd?

First, BlackBull Markets is fully registered with the Financial Service Providers Register (FSPR) of New Zealand, offering regulatory clarity and peace of mind. Unlike offshore brokers, this license means client funds are protected under local legal frameworks.

Second, the broker leverages Equinix NY4 and LD5 data centers, two of the most advanced financial hosting infrastructures in the world. This low-latency setup ensures fast execution times, making it ideal for high-frequency trading (HFT), scalping, and EA (expert advisor) strategies. Traders no longer need to worry about slippage during volatile market conditions.

Third, BlackBull uses No Dealing Desk (NDD) execution—a model that removes conflict of interest between broker and trader. All orders are passed directly to liquidity providers, ensuring market transparency and no re-quotes.

Perhaps most importantly, BlackBull offers true RAW ECN spreads. This means traders gain access to institutional-grade pricing with spreads from 0.0 pips, especially appealing for scalpers and high-volume traders who prioritize cost efficiency.

Whether you’re a day trader looking for lightning-fast execution, or a hedge fund deploying a latency-sensitive algorithm, BlackBull Markets in 2025 provides a competitive edge through its performance-first infrastructure and institutional-grade technology.

As more traders search for stability, speed, and institutional pricing in 2025, it’s no surprise they are turning to BlackBull Markets as a trusted execution partner.

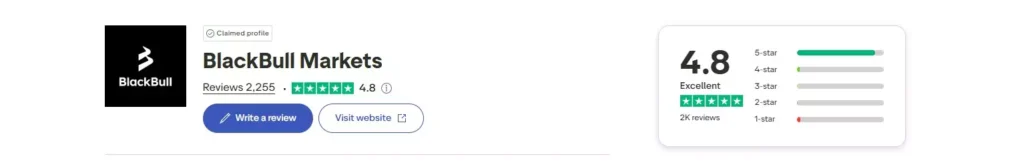

🟢 Trustpilot Summary – BlackBull Markets (Updated)

BlackBull Markets currently holds an impressive Trustpilot rating of 4.8/5, based on 2,255 reviews. This high score categorizes the broker as “Excellent” on Trustpilot’s scale.

- ✅ Overwhelmingly positive feedback from traders around the world

- ✅ 96% of negative reviews receive a response — typically within 1 week

- 🟢 Most users give 5 stars, with very few 1-star ratings

- 🔒 Verified profile – BlackBull is officially listed and cannot pay to hide negative reviews

🧠 What Traders Are Saying on Trustpilot:

“Fast execution, solid platform, and no issues with withdrawals — BlackBull is a real ECN broker that doesn’t mess around.”

“Been with them for 2+ years, and support always responds. Better than my previous FCA-regulated broker.”

Even among the few lower ratings, most concerns were addressed by the team in a timely manner, which shows strong after-sale service and transparency.

Is BlackBull Legit in 2025? What You Should Know Before Depositing

A question that keeps popping up in trader communities:

“Is BlackBull Markets really legit in 2025?”

✅ The short answer is yes—but let’s break it down with facts, not assumptions.

🔐 Regulatory Oversight That Matters

BlackBull Markets operates under dual regulation:

- The FMA (Financial Markets Authority) in New Zealand, a Tier-2 regulator respected for its strict client fund segregation and audit requirements.

- The FSA Seychelles, which offers more operational flexibility but still requires basic compliance and transparency.

While BlackBull is not regulated by ASIC (Australia) or the FCA (UK)—two of the most conservative regulators—its FMA license still provides meaningful legal oversight. For many traders, especially those outside of the UK or EU, that’s an acceptable and efficient balance between compliance and speed.

Fund Safety: Segregation and Bank Trustworthiness

When you deposit with BlackBull, your funds are not held in the same accounts as the broker’s own money.

Instead, all client funds are segregated in Tier-1 banks, meaning institutions with the highest capital reserves and credit ratings. This reduces counterparty risk in the event of company insolvency.

⚖️ Execution Integrity and Transparency

BlackBull doesn’t operate a dealing desk.

This is a big deal. Why?

Because there’s no conflict of interest—they don’t profit from your losses. All trades are routed to external liquidity providers using STP/ECN infrastructure, and the broker earns revenue purely from commissions. That aligns incentives with the trader’s success.

You also get order execution audit trails, and slippage reports can be requested—another sign of operational transparency.

🔍 Due Diligence Still Matters

Here’s the nuance:

If you’re trading with over $100,000+ capital, or you’re a resident of a country that mandates FCA/ASIC oversight, you’ll need to carefully evaluate whether the FMA/FSA combo is enough for you. Some institutional clients may prefer multi-jurisdictional regulation.

For most retail traders, algo traders, and high-speed strategy users, BlackBull provides a compelling mix of trust, execution speed, and pricing.

Absolutely—BlackBull Markets is a legitimate broker with transparent operations, regulatory registration, and robust infrastructure.

However, legitimacy doesn’t mean “risk-free.” You should still:

- Check your jurisdiction’s view on offshore-regulated brokers

- Avoid overexposing your capital in any one broker

- Test withdrawal processes before scaling up

For risk-tolerant traders who value performance, raw spreads, and honest execution, BlackBull remains a trusted name in 2025.

How Competitive Are BlackBull Spreads in 2025? A Brutally Honest Look

Let’s talk spreads—because spreads matter.

- Standard account: from 0.8 – 1.2 pips on EUR/USD

- ECN Prime account: from 0.0 pips, with commission $6/lot

- Pro ECN (custom): for serious capital, offers tailored pricing

Compared to brokers like Pepperstone or IC Markets, BlackBull holds its own in the ECN space. For scalpers or prop firm traders, its execution speed and spread consistency are highly rated.

Caution: Spreads may widen during news or rollover times. Always use a VPS if latency matters to you.

Does BlackBull Offer Copy Trading in 2025? The Surprising Answer

Yes, but with a twist.

Unlike brokers that push MetaTrader’s copy trading plugin, BlackBull integrates with third-party social trading platforms like:

- ZuluTrade

- Myfxbook Autotrade

- HokoCloud

This opens the door for signal providers, copy traders, and portfolio managers to connect globally without platform lock-in.

However, copy trading isn’t promoted as heavily as manual or algo-based trading. If you’re looking for in-house signal marketplaces, look elsewhere.

BlackBull’s Strengths and Weaknesses – What You Must Consider

Strengths:

- Institutional-grade execution and liquidity

- No restriction on trading strategies

- Multiple account types for serious traders

- Great for EA users, scalpers, and prop traders

Weaknesses:

- Limited educational resources

- No FCA/ASIC license

- Copy trading is external, not native

Expert Recommendations for Traders Considering BlackBull

- ✅ If you are a scalper or algo trader, this is a solid choice. Combine it with a low-latency VPS and your trading edge gets sharper.

- 🟡 If you’re a beginner, platforms like Exness or Pepperstone offer better guidance and simplicity.

- ⚠️ If regulation matters to you (FCA, ASIC), you might want to look at dual-regulated brokers.

Always test on a demo or a micro-deposit ECN account before going live. Every broker behaves slightly differently under pressure.

Risks to Keep in Mind Before Funding a BlackBull Account

No broker is perfect. Here’s what to remember:

- ECN accounts require understanding of commission + spread models

- Fast execution doesn’t mean no slippage — especially during high volatility

- Customer support can be slower outside business hours in NZ timezone

- Withdrawal methods may differ depending on region

Tip: Read their full T&Cs before funding. If you’re trading larger capital, ask for a dedicated account manager.

Final Thoughts: Is BlackBull Worth It in 2025?

If you’re serious about execution speed, deep liquidity, and advanced trading infrastructure, BlackBull deserves your shortlist.

It’s not the most beginner-friendly broker. But it’s powerful, fast, and customizable—qualities that matter if you want trading to feel more professional than casual.

Verdict: BlackBull is legit, advanced, and built for traders who know what they want.

Register Your BlackBull Account in Minutes

✅ Open a live trading account in under 2 minutes.

No hidden fees. No dealing desk. Just fast, secure, real trading with ECN execution.

Disclaimer: Trading CFDs carries a high level of risk and may not be suitable for all investors. This content is provided for informational purposes only and does not constitute financial or investment advice. Always seek guidance from a licensed financial professional before making any trading decisions.

🔗 What to Read Next from Us

Looking to compare BlackBull with other top brokers? Here’s what we recommend: