Blue Guardian Prop Firm Review: Is Blue Guardian Legit? How the Blue Guardian Funding Program Really Works

✅ Overview of Blue Guardian Prop Firm

Blue Guardian is a proprietary trading firm founded in 2022 that provides funded capital to traders across forex, commodities, indices, and cryptocurrencies. The company has quickly attracted a large global community of more than 60,000 traders from over 130 countries, thanks to its flexible evaluation programs and competitive profit split structure (Source: Blue Guardian Official).

The firm is registered in Dubai, UAE, and states that it partners with regulated brokers and licensed liquidity providers to ensure a safe and transparent trading environment (Source: InsideTrade).

One of the standout benefits of the Blue Guardian Prop Firm is the potential for traders to retain up to 90% of their profits, along with a fast and reliable payout process once trading conditions are met (Source: Blue Guardian Official).

Additionally, Blue Guardian receives positive recognition for its 24/7 customer support and an active trader community hosted on Discord — making it easier for users to connect, share experiences, and receive timely assistance whenever needed (Source: Trustpilot Reviews).

Blue Guardian Funding Program Structure

Blue Guardian offers multiple funding challenge programs tailored to different trader profiles (Source: InsideTrade.co). Each program has its own profit targets and risk rules, but the key advantage is that there are no time limits for any evaluation stage — allowing traders to progress at their own pace without deadline pressure (Source: TradersReview.co.za).

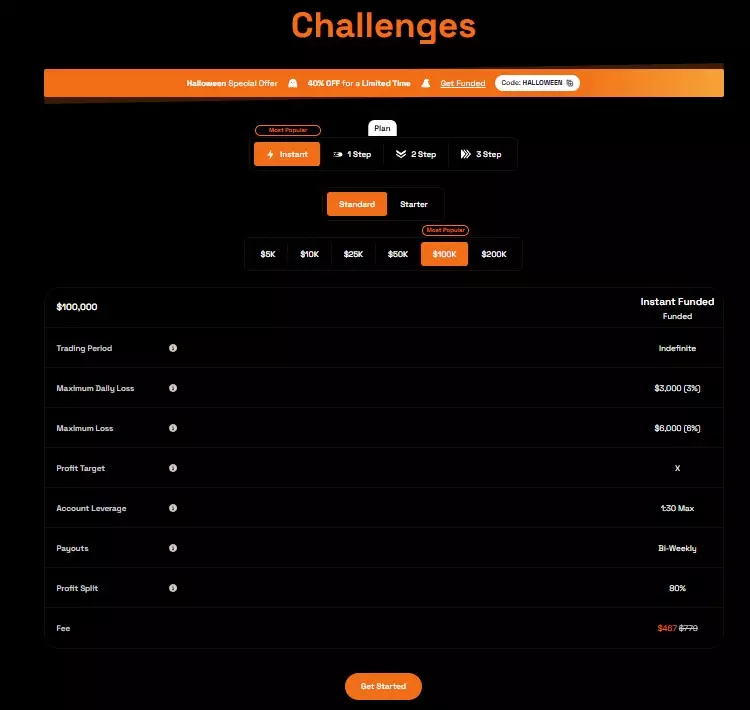

Instant Funding – Trade Real Capital Immediately

This is the fastest funding option because no challenge or evaluation is required.

- Funding sizes: $5,000 to $200,000

- No profit target required

- Daily drawdown: 3%

- Maximum trailing drawdown: 6%

- Profit split: 80%

- Withdraw profits anytime

- $200K account leverage limited to 1:15 for risk protection

Best suited for confident and disciplined traders who want immediate capital (Source: BlueGuardian.com).

1-Step Challenge (Rapid) – One Evaluation Phase

Traders need to complete only one stage before becoming funded.

- Profit target: 10%

- Daily loss limit: 4%

- Maximum overall loss: 6%

- Minimum 3–5 trading days

- Consistency requirement: around 0.5% profit per active trading day

- Profit split after funding: 85% → 90%

- Payouts every 14 days

A fast-track option for experienced traders, but requires strict risk control (Sources: BlueGuardian.com, TradersReview.co.za).

2-Step Challenge – Unlimited & Elite Options

Two evaluation stages with two difficulty choices:

Unlimited:

- Phase 1: 8%

- Phase 2: 4%

- Max drawdown: 8% static

Elite:

- Phase 1: 10%

- Phase 2: 4%

- Max drawdown: 10% static

Shared rules:

- No time limits in any phase

- Minimum 4–5 trading days per phase

- Profit split after funding: 85% → 90%

- Option to merge funded accounts: up to $400,000 AUM

Unlimited targets are easier, while Elite offers more breathing room with a higher drawdown limit (Sources: BlueGuardian.com & InsideTrade.co).

3-Step Challenge – Low-Cost for Stable Growth

Ideal for beginners or budget-conscious traders.

- Profit target per phase: 6%

- Daily loss limit: 4%

- Max overall loss: 8%

- No time restriction

- Very low fees — around $50 for a $10K account

Designed for learning and building consistency, though it takes longer to complete (Sources: TradersReview.co.za & InsideTrade.co).

Unified Payout System for Funded Accounts

Across all funded programs:

- First payout 14 days after first trade

- Future payouts every 14 days

- Optional add-ons:

- Faster 7-day payouts

- 90% profit split from the start

This structure provides flexibility for both aggressive and long-term trading styles (Source: BlueGuardian.com).

Summary of Blue Guardian’s Funding Flexibility

- No evaluation deadlines

- Multiple paths depending on skill level and budget

- Clear and enforceable risk rules

- Focus on consistency over luck

Traders can choose fast funding (Instant / 1-Step) or cost-efficient progression (3-Step).

Who Should and Should Not Join Blue Guardian Prop Firm

Who Is Blue Guardian Suitable For?

Blue Guardian is a strong choice for disciplined and experienced traders who understand risk management well. If you are confident in your trading strategy and want to access larger capital quickly, programs like Instant Funding or the 1-Step Challenge are highly attractive.

The profit split is among the highest in the prop firm industry — up to 90% — meaning traders keep most of what they earn (Source: BlueGuardian.com).

Traders who dislike time pressure will appreciate the fact that there are no evaluation deadlines. You can take your time, wait for high-probability setups, and avoid rushing through the challenge.

Blue Guardian also supports multiple asset classes, including forex, gold, oil, indices, and cryptocurrencies, with reasonable leverage and no restrictions on news trading or holding positions overnight/weekends (Source: BlueGuardian.com). This makes the firm compatible with many trading styles such as swing trading, day trading, and algorithmic trading.

For beginners, the low-cost 3-Step Challenge is a safe entry point, while skilled traders can choose 1-Step or 2-Step evaluations for faster access to funded accounts (Source: InsideTrade.co).

Blue Guardian rewards sustainable and steady trading, thanks to consistency rules and the Guardian Shield protection — perfect for traders who avoid high-risk, “all-in” behavior.

✅ Best for:

- Traders who manage risk carefully

- Those seeking high payouts and fast funding options

- Traders who prefer flexibility and no time limits

- Both beginners and seasoned professionals

Who May Not Be a Good Fit for Blue Guardian?

Blue Guardian may not be ideal for traders who take excessive risks or treat trading like gambling. Drawdown limits are strict — 3–4% daily and 6–10% overall, meaning there is very little room for large mistakes.

Traders who rely on ultra-short scalping should be cautious as each trade must remain open for at least 2 minutes to qualify, which prevents certain tick-scalping strategies (Source: BlueGuardian.com).

Those using Martingale, grid, or “all or nothing” high-risk strategies may violate the firm’s Gambling Rule if their approach is deemed too aggressive (Source: BlueGuardian.com).

Blue Guardian does not offer free trials and has limited educational resources, which may be a disadvantage for traders who want guidance before investing a challenge fee (Source: InsideTrade.co).

Support is currently English-only, so traders with language barriers may struggle to communicate smoothly (Source: InsideTrade.co).

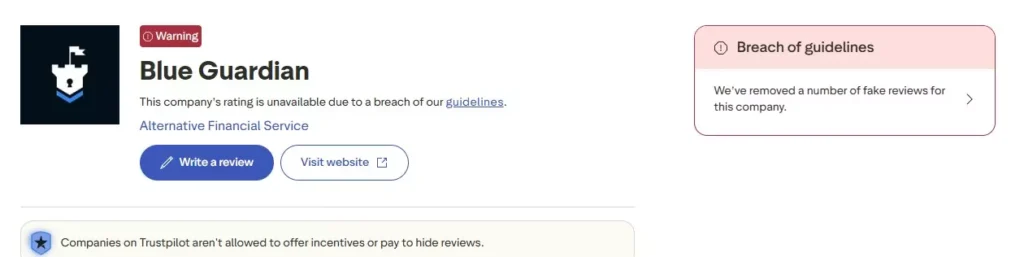

Finally, some traders might hesitate due to past concerns about review authenticity on Trustpilot — a transparency factor worth considering if brand reputation is important to you.

❌ Not ideal for:

- Gambling-style traders

- Ultra-fast scalpers (under 2-minute trades)

- Traders needing a free trial or training material

- Those uncomfortable with English-only support

- Traders who prefer firms with flawless public reputation

Conclusion

Blue Guardian is best suited for traders who are disciplined, methodical, and focused on long-term profitability. It may not be suitable for traders who rely on risky tactics or expect a completely relaxed set of rules.

Ultimately, the right choice depends on whether your trading strategy and psychology align with Blue

Community Feedback from Traders

Positive Reviews

Many traders speak positively about Blue Guardian on review platforms. They appreciate:

- Fast payouts

- Clear rules and easy-to-use dashboard

- Friendly and quick customer support

- Active and helpful Discord community

For example, several Trustpilot users reported receiving multiple payouts successfully — one trader said they had four payouts in a row, around $4,000 each, and the support team guided them through the process smoothly (Source: Trustpilot).

Some traders even mentioned that payouts were completed within the next business day, especially when processed through the RiseWorks payment method (Source: Trustpilot).

Overall, positive feedback shows Blue Guardian is paying traders on time and supporting them well, which helps build trust.

Negative Reviews

However, not all feedback is positive. Some traders have shared concerns:

- Technical issues when switching trading platforms

- Complaints about wider spreads on MT5 than expected

- High costs for scalpers due to commission and spread

- KYC (identity verification) sometimes slow

On Reddit, a trader reported that when they switched from MT5 to Match-Trader during an Instant Starter challenge, their previous profit (0.36%) did not carry over. They felt this was unfair and wished the company communicated better (Source: Reddit).

A few users on Reddit simply advised others to “stay away,” although without detailed explanation (Source: Reddit).

On Trustpilot, about 13% of reviews are 1-star — showing that some users were dissatisfied (Source: Trustpilot).

Trustpilot Review Controversy

In mid-2025, Trustpilot flagged Blue Guardian due to suspected fake reviews and temporarily removed its star rating. They stated that a number of reviews were deleted after investigation (Sources: Trustpilot, FXVerify).

This situation has caused some traders to question the reliability of Blue Guardian’s online reputation.

However:

- It does not prove the company provides bad service

- Many other new prop firms have faced similar issues

- Trustpilot is actively removing fake reviews across the industry

The best approach is to cross-check information on independent platforms and communities, not rely only on star ratings.

Summary of Trader Feedback

✅ Many traders confirm Blue Guardian delivers fast payouts and good support

⚠ Some users report platform handling issues and transaction costs

❗ Review-spam concerns reduce trust in online ratings

Conclusion:

Blue Guardian generally performs well in key areas like support and payouts, but traders should review all rules carefully and be aware of potential issues before joining.

Final Verdict & Recommendations

So, is Blue Guardian a good option in 2025? The answer is “yes — with caution”. Here are my concluding thoughts and suggestions.

The Good

- Blue Guardian offers flexible challenge types (1-step, 2-step, 3-step, instant) which helps traders pick what fits their budget and style.

- The profit share (up to ~90%) and relatively short payout frequency are competitive.

- No rigid time limits in many programmes is a plus for disciplined traders who want to trade at their own pace.

- Many traders have had smooth experiences, showing that the firm can deliver as promised when the rules are followed.

The Cautions

- The firm’s reputation is somewhat mixed: the Trustpilot flag for fake reviews is a red-flag and suggests you should verify things for yourself, not rely purely on glowing testimonials.

- While many get paid, there are credible reports of funding being revoked or payout refused, especially on larger amounts — this means the risk of refusal exists.

- The risk / drawdown limits and consistency rules require careful trading — this is not a “free money” prop – you must manage risk strictly.

- Always read your specific “funded account terms” carefully: news trading rules, position size limits, instrument restrictions, etc., can differ.

My Recommendation for Traders

If you’re considering Blue Guardian, here are some best practices:

- Start small: Use a smaller challenge/account size first. Pass it, take a small withdrawal to test the payout mechanics.

- Keep detailed records: Maintain clear logs of your trades, risk management, strategy — in case you need to dispute a “breach” claim.

- Read all terms: Especially the funded account contract, and any fine-print about news trading, consistency, drawdowns.

- Withdraw regularly: Don’t let a large profit pile up before you withdraw; sometimes smaller frequent payouts reduce risk of surprises.

- Trade within risk rules: The drawdown and consistency rules mean you must trade conservatively enough to stay in line — plan your strategy accordingly.

- Check broker/instrument spreads: While the firm supports many assets, depending on instrument/spread your edge may differ — do due diligence.

Conclusion

Blue Guardian Prop Firm offers a legitimate pathway to funding for forex/CFD traders, with competitive terms and a variety of account types. However, like all prop firms, it comes with conditions and risk. The firm appears to pay many traders reliably, but the existence of complaints means you should proceed with awareness and vigilance. If you trade disciplined, understand the rules, and proceed step-by-step, Blue Guardian could very well serve you well. On the other hand, if your strategy relies on aggressive drawdown risk, big one-time profits, or you want minimal oversight, this may not be the optimal fit.

Further Reading on Blue Guardian Prop Firm

If you’re researching the Blue Guardian Prop Firm in more depth, here are some related resources you may find useful:

- Blue Guardian vs The Trading Pit: Side-by-Side Prop Firm Comparison

- Which Countries Are Restricted from Joining Blue Guardian?

- In-Depth Blue Guardian Prop Firm Review and Trader Insights