The Trading Pit – A Trusted Funding Fund for Traders in 2025

Overview of The Trading Pit

The Trading Pit is a proprietary trading firm (Prop Trading Firm) established to identify and partner with talented traders worldwide. What sets The Trading Pit apart from many other firms is its unique combination of cutting-edge technology, flexible trading conditions, and a transparent partnership model.

The Trading Pit currently offers funding of up to $250,000, along with attractive benefits such as high profit splits, flexible trading platform options, and professional customer support — based on official data from the company’s website and reputable review sources.

According to the official website, The Trading Pit was officially established in 2022 and is headquartered in Liechtenstein. However, several sources suggest that the company began conceptualizing and running pilot operations in 2021, before officially expanding globally

Is The Trading Pit trustworthy?

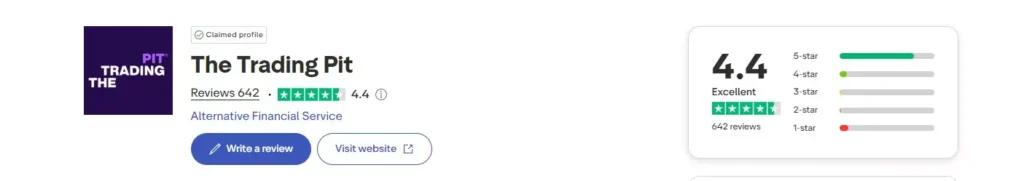

On Trustpilot, The Trading Pit holds a rating of 4.4 out of 5 based on 642 reviews, earning the “Excellent” status. The majority of users gave 5-star ratings, reflecting a high level of satisfaction with the company’s services and trading experience. Many traders praise The Trading Pit for its transparency, stable platform performance, and responsive customer support. These key factors have helped the firm build strong trust in the global trading community.

Challenge Rules and Participation Fees

The Trading Pit – Opportunity to Receive Trading Capital of Up to $5 Million

The Trading Pit is one of today’s most reputable prop trading firms, offering traders the opportunity to scale their accounts up to $5,000,000 through its Scaling Plan. This makes it an ideal choice for traders with consistent strategies who want to maximize profits without committing large personal capital.

Depending on the type of challenge, the required number of trading days varies:

- Futures Prime: Traders must complete a minimum of 3 trading days in each challenge phase.

- CFD Prime: Traders must achieve at least 3 profitable days to pass the challenge.

With flexible rules and massive funding potential, The Trading Pit has become an attractive destination for both new and experienced traders seeking long-term partnerships with a globally recognized prop firm.

Challenge packages start at just $99, and if you successfully complete the program, your entire fee will be refunded.

Pros

- Generous funding opportunities with limits up to $5 million

- Multiple account scaling plans to grow your trading capital

- Flexible trading conditions and rules designed for different strategies

Cons

- No instant funding — traders must complete a challenge first

- No demo accounts available for practice before joining

Challenge Costs & Structure

The Trading Pit offers two programs: CFDs and Futures.

CFDs

- Evaluation Type: 1 phase (Prime) or 2 phases.

- Profit Target: 8–10%.

- Daily Drawdown: ~4% (for $50k account = $2,000).

- Max Loss: ~7% (for $50k account = $3,500, fixed).

- Minimum Profitable Days: 3 days.

- Profit Split: up to 80%.

- Account Sizes: $5k · $10k · $20k · $50k · $100k · $200k.

* Parameters may vary between 1-phase and 2-phase models.

Futures

- Contracts: Micros/Standard (50/5, 100/10, 150/15).

- Challenge Duration: 30 days; Profit Split up to 80%.

Source: The Trading Pit checkout page (CFDs & Futures).

Trading Conditions and Supported Platforms

Trading Instruments

The Trading Pit offers a wide range of instruments, including Forex, indices, commodities, cryptocurrencies, and various other derivative markets.

Trading Platforms

Traders can choose from multiple platforms, such as:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- DXtrade

- TradingView (connected via partner brokers)

Spreads & Fees

- Competitive spreads starting from 0.1 pip for the EUR/USD pair.

- Reasonable commission fees, depending on account type and platform.

Registration and Participation Process

- Register an account on the official website.

- Select your preferred program (Challenge or Instant Funding).

- Pay the participation fee.

- Start trading and follow the rules.

- Upon meeting all requirements, receive a funded live account and start profit sharing.

Comparison of The Trading Pit with Established Prop Firms

The table below provides a quick comparison of The Trading Pit with other well-known, long-standing prop firms, including FTMO (2015), Topstep (2012), and The5ers (2016), based on criteria such as founding year, evaluation model, supported instruments, time limits, minimum trading days, and availability of instant funding programs.

| Criteria | The Trading Pit | FTMO | Topstep | The5ers |

|---|---|---|---|---|

| Founded | 2021 (global since 2022) | 2015 | 2012 | 2016 |

| Evaluation Model | 1-step (CFD/Futures) & 2-step (Futures) | 2-step (CFD) | 2-phase (Futures) | 1–2 step (CFD) |

| Supported Instruments | CFD + Futures | CFD | Futures | CFD |

| Time Limit | No | Yes | Yes | Depends on plan |

| Minimum Trading Days | ≥ 3 days/phase | Yes | Yes | Depends on plan |

| Instant Funding | No | No | No | Yes |

| Maximum Profit Split | 80% | 90% | ~90% | ~90% |

| Key Highlight | No time limit, supports both CFD & Futures | Standard 2-step process | Futures-focused | Multiple plan options |

* Information may change; always check the official website before applying.

Should You Join The Trading Pit?

The Trading Pit is a reputable prop trading firm known for its transparent policies, fair trading conditions, and opportunities to scale your account to higher funding levels. If you are a disciplined trader with a clear strategy and aim to generate consistent profits from a funding program, this is a solid option to consider in 2025.

However, before joining, you should:

- Carefully read all terms and conditions.

- Select a program that matches your trading style.

- Manage capital and risk responsibly.

💡 Advice for New Traders

If you are new to prop firms like The Trading Pit, take the time to fully understand the terms, trading rules, and funding model. Start with a smaller account size to familiarize yourself with the process, avoid using excessive leverage, and always prioritize risk management.

Choosing a reputable prop firm will help you avoid unnecessary risks and increase your chances of long-term success in trading.

Disclaimer: The information in this article is for informational purposes only and should not be considered investment advice. Trading financial instruments, especially with leverage, carries a high level of risk and may result in the loss of your entire capital. Please consider carefully before participating and only trade with funds you can afford to lose.