Equity Edge Prop Firm (2025): Real Trader Reviews, Pros, Cons & Payment Transparency

Equity Edge is a relatively new UK-based prop firm that’s been gaining attention among traders since its launch in 2023. The firm claims to provide affordable access to funded accounts and one of the highest profit splits in the industry — but how true are those claims?

In this review, we’ll take a balanced look at Equity Edge’s funding programs, payout reputation, and real trader feedback — including insights from Ed Cat, a trading YouTuber from Forex Insights SA who personally tested the firm.

Company Overview: Equity Edge Prop Firm

Founded in 2023, Equity Edge has quickly positioned itself as a low-cost prop trading option for retail traders. The company operates under Equity Edge Group Ltd (UK) and offers funding challenges starting from $2,500 up to $100,000, with the potential to scale to $2 million for consistently profitable traders.

Their online presence is significant — over 58,000 members on Discord, a growing TikTok and Instagram following, and a verified Trustpilot score of 3.9/5 based on 821 reviews (as of October 2025).

However, unlike larger firms such as FTMO or MyForexFunds (before its closure), Equity Edge does not appear to be regulated by any major financial authority, meaning traders should always proceed with awareness of potential risk.

Account Types and Trading Conditions

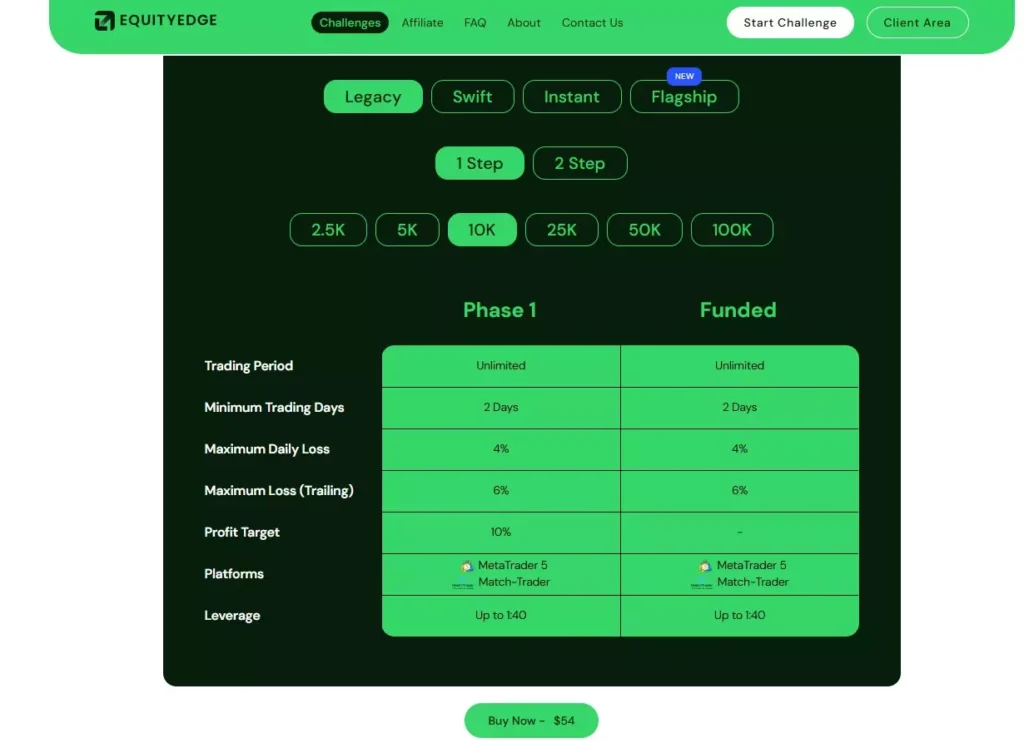

Equity Edge offers four main account types — Legacy, Swift, Instant, and Flagship — each tailored to different trading styles and risk preferences.

The Legacy program follows a classic evaluation model with both 1-Step and 2-Step options, featuring a 10% profit target, 4% daily drawdown, and up to 6–8% maximum loss, with leverage up to 1:40.

The Swift program provides slightly lower profit targets — 8% for Phase 1 and 5% for Phase 2 — along with 3–4% daily and 5–8% maximum drawdown, and leverage up to 1:30, making it ideal for conservative traders.

The Instant Funding model gives traders immediate access to capital with 3% daily and 5% total drawdown, a 15% consistency rule, 1% max risk per trade, and 1:30 leverage, but includes an inactivity rule after 30 days.

The Flagship program is the firm’s most flexible and advanced model, offering 10% (1-Step) or 8% and 5% (2-Step) profit targets, 4% daily drawdown, 6–10% maximum loss, and up to 1:100 leverage, providing more room for experienced traders.

From a trader’s perspective, these parameters are competitive and align with industry standards. Legacy and Swift suit traders focused on steady, low-risk growth; Instant appeals to experienced traders seeking quick access to funded capital; while Flagship stands out as the premium choice for those aiming for higher leverage, flexibility, and long-term performance.

Platform Experience: Tested by a Real Trader

According to Ed Cat, a trading YouTuber from Forex Insights SA, who personally purchased and tested an Equity Edge account:

“When I bought my account, MT4 and MT5 weren’t available yet. Instead, they had their own custom platform that integrated directly with TradingView — and I have to say, it was surprisingly smooth. The interface was intuitive, execution was fast, spreads were tight, and I experienced minimal slippage.”

This aligns with what several traders have mentioned in online communities — Equity Edge’s execution quality is decent, and the TradingView integration makes analysis and order management much more convenient for retail traders.

Recently, the firm also announced plans to reintroduce MT4 and MT5, a move that could attract a wider range of professional traders.

Profit Split and Payout Policy

Equity Edge advertises a profit split of up to 90%, one of the highest in the industry. The standard rate is 80%, but traders can unlock 90% by paying a small upgrade fee.

Payouts are processed every 14 days, which is faster than many competitors who typically require a 30-day waiting period for the first withdrawal.

However — and this is a crucial point — some traders have reported issues with delayed or denied payouts, particularly with larger funded accounts or aggressive trading styles.

As Ed Cat points out:

“On paper, everything looks great — 90% profit split, quick payouts, low fees. But looking at Trustpilot and community reports, there have been cases where payouts were delayed or even denied. And that’s always a red flag for any prop firm.”

This sentiment is echoed in several Reddit and ForexPeaceArmy threads, where traders claim Equity Edge occasionally withholds payments, often citing vague rule violations.

While these cases are not the majority, they’re important to acknowledge — especially for traders aiming for larger profits.

Pricing and Promotions

One of Equity Edge’s strongest appeals is its affordability. Challenges are priced much lower than those of competitors — for instance, a $2,500 challenge costs around $20, making it one of the most budget-friendly entry points in the prop trading space.

The firm frequently runs seasonal discounts, sometimes offering up to 50% off challenge fees, especially around major trading events or holidays.

As Ed Cat notes:

“If you’re looking to enter the prop trading space cheaply, Equity Edge might be worth trying — just be aware of the payout risk if you start making serious profits.”

Community and Reputation

Equity Edge has a large Discord community (58,000+) where traders share results, strategies, and concerns. This active community is a positive sign for engagement, but it also includes mixed feedback about customer support responsiveness and account verifications.

On Trustpilot, the company maintains a 3.9/5 rating (821 reviews), indicating moderately positive feedback — with most users praising low costs and platform usability, while a minority complain about payout consistency.

Final Verdict

Equity Edge presents itself as a fast-growing, affordable prop firm offering solid trading conditions, tight spreads, and one of the industry’s most competitive profit splits.

However, the firm’s unregulated status and payout-related complaints mean traders should approach with measured caution — especially if scaling to higher funding tiers.

“It takes a lot of work to hit your profit target,” says Ed Cat, “so being denied a payout after that effort can be devastating. That’s why traders should weigh affordability against reliability.”

In summary:

| Category | Verdict |

|---|---|

| Trust & Regulation | ⚠️ Unregulated – proceed with caution |

| Trading Conditions | ✅ Competitive and fair |

| Platform Experience | ✅ Smooth (TradingView integration, low latency) |

| Payout System | ⚠️ Some reports of delays/denials |

| Affordability | ✅ Excellent (one of the cheapest challenges available) |

| Overall Score | ⭐⭐⭐½ / 5 – “Good but not flawless” |

Bottom line:

If you’re a new or intermediate trader looking for low-cost entry and flexible challenges, Equity Edge is worth trying — just keep your expectations realistic and start small.

As always, do your due diligence, read payout policies carefully, and trade responsibly.

Disclaimer: This review is for informational purposes only and does not constitute financial advice. Always conduct your own research before joining any prop trading program.

FAQ – Equity Edge Prop Firm (2025)

1. What is Equity Edge Prop Firm?

Equity Edge is a UK-based proprietary trading firm founded in 2023. It offers funded trading programs that allow traders to access capital up to $2 million after completing a trading challenge or instant funding option.

2. Is Equity Edge regulated?

No, Equity Edge is not regulated by any major financial authority. Traders should always be aware of potential risks and trade responsibly.

3. What trading platforms does Equity Edge support?

Equity Edge currently supports MetaTrader 5, Match-Trader, and a custom TradingView-integrated platform. MT4 and MT5 are expected to be fully reintroduced soon.

4. What profit split does Equity Edge offer?

The firm offers up to a 90% profit split. The standard payout is 80%, but traders can upgrade to 90% by paying a small additional fee.

5. How often are payouts processed?

Payouts are available every 14 days, which is faster than many other prop firms that require a 30-day waiting period for the first withdrawal.

6. What are the main account types at Equity Edge?

There are four main programs: Legacy, Swift, Instant, and Flagship — each offering different drawdown rules, profit targets, and leverage ranging from 1:30 to 1:100.

7. What is the minimum profit target in the challenges?

Depending on the account type, profit targets range from 8% to 10% in Phase 1 and 5% in Phase 2 for two-step challenges.

8. Are there any payout issues reported?

Some traders have reported delayed or denied payouts, especially on larger accounts or aggressive trading styles. While not widespread, these reports are worth noting.

9. How much does it cost to join Equity Edge?

Challenge prices start as low as $20 for a $2,500 account, making it one of the most affordable entry points in the prop trading industry.

10. Is Equity Edge recommended for beginners?

Yes — but with caution. Equity Edge is ideal for beginners and intermediate traders who want low-cost access to funding. However, due to its unregulated status and mixed payout reputation, traders should start small and scale gradually.

🧭 Explore More Prop Firm & Forex Insights

If you found this review on Equity Edge Prop Firm (2025) helpful, you might also enjoy our other in-depth analyses and trading resources:

- 🔹 Maven Trading Review (2025) — A full breakdown of Maven’s funding structure, rules, and payout performance.

- 🔹 Blue Guardian Prop Firm Review — Discover how Blue Guardian compares in terms of profit targets, consistency rules, and scaling plans.

- 🔹 The5ers Prop Firm Review (2025) — See why The5ers remains one of the most trusted prop firms for professional traders.

- 🔹 Forex Brokers & Trading Tips — Learn how to choose a reliable broker, manage leverage effectively, and avoid common trading mistakes.

Each review is based on verified trader feedback and transparent testing, helping you make smarter, data-driven trading decisions.