The5ers Prop Firm Review 2025: Pros, Cons, and Trader Insights — About The5ers

The5ers (also known as The Five Percenters) is a proprietary trading firm headquartered in Israel. Founded in 2016 by two professional forex traders, Gil Ben Hur and Snir Ahiel, the firm’s mission is to identify disciplined traders with strong risk management skills and provide them with real capital once they pass the firm’s evaluation process.

Quick Overview

- Type: Proprietary Trading Firm

- Founded: 2016

- Headquarters: Israel

- Founders: Gil Ben Hur, Snir Ahiel

Business Model

- Evaluation via demo/evaluation steps.

- Profit targets & strict risk management rules.

- Scaling plan to grow account size.

Why It Matters

- Strong focus on discipline & risk control.

- Clear evaluation programs with scale-up path.

- Global trader community & learning support.

Firm Overview

Broker Partner

Commercial Liquidity ProviderTrading Platforms

cTrader MT5Available Payment Options

Apple Pay Bank Transfer Credit / Debit Card Cryptocurrency Google Pay PayPalWithdrawal Methods

Bank Wire Crypto RiseworksInstruments & Markets

Leverage Overview

| Assets | Instant | 1-Step | 2-Steps | 3-Steps |

|---|---|---|---|---|

| FX | n/a | 1:30 | 1:100 | 1:10 |

| Metals | n/a | 1:10 | 1:33 | 1:3 |

| Indices | n/a | 1:7.5 | 1:25 | 1:2.5 |

| Energy | n/a | 1:1.5 | 1:5 | 1:0.5 |

| Crypto | n/a | 1:0.6 | 1:2 | 1:0.2 |

Firm Rules

News Trading

- Bootcamp & Hyper-Growth: Trading during news is allowed, except when using “bracket strategies” that place pending orders on both sides of major events.

- High Stakes: Opening or closing trades is restricted from 2 minutes before until 2 minutes after high-impact news releases.

Copy Trading

- Permitted under High Stakes and Hyper-Growth, but with clear limits.

- Managing more than $500K means you can no longer mirror the same trades across multiple accounts.

- Copying from an external account is fine, but only if the account belongs to the same trader.

- Third-party signal or copy services are not accepted.

- Bootcamp-to-Bootcamp copy trading is prohibited.

- Extended Options: Thanks to The5ers’ collaboration with Prop Firm One, traders can now synchronize trades across multiple proprietary firms. This integration boosts flexibility and scalability while still respecting The5ers’ house rules.

Expert Advisors (EAs)

Automated trading tools are acceptable provided they adhere to The5ers’ guidelines:

- A Stop Loss (SL) must be set for every trade.

- EAs may not copy signals from other traders.

- Forbidden techniques include tick scalping, latency or reverse arbitrage, hedge arbitrage, and use of trade emulators.

- Violating these rules leads to account cancellation, banning, and no refunds.

- These restrictions apply to all programs, including Bootcamp and Instant Funding.

High Stakes Program

- A trader must demonstrate at least 3 profitable days.

- Each profitable day requires gains equal to or above 0.5% of the starting balance.

Bootcamp Rules

- Stop Loss is mandatory on all orders and must be placed within 3 minutes of trade execution.

- No trade may risk more than 2% of the account balance.

- A 3% daily loss limit (“soft breach”) applies during the funded stage.

- Opening trades without an SL, or exceeding 2% risk, counts as a violation. Reaching 5 violations results in account termination.

Prohibited Practices

- Taking one-sided trades without adapting to market conditions.

- Arbitrage based on price discrepancies.

- Placing bracket orders around news releases.

- Exploiting system glitches such as feed delays or misquotes.

Inactivity Rule

Accounts with no new trades for 30 consecutive calendar days will automatically expire.

Allowed vs Not Allowed

| ✅ Allowed | ❌ Not Allowed |

|---|---|

| Trading news (except bracket orders in Bootcamp/Hyper-Growth) | Bracket strategies around high-impact news |

| Copy trading within your own accounts (with limits) | Copy trading between Bootcamp accounts |

| External copy trading if it’s your own account | Third-party signals or account mirroring |

| Using Expert Advisors with Stop Loss | Tick scalping, arbitrage, emulators |

| High Stakes program (3 profitable days, 0.5% min/day) | Risking over 2% per trade or 5 SL violations |

| Bootcamp with strict SL (≤2% risk per trade) | Trading without SL or ignoring daily drawdown rules |

| Participation in PropFirmOne integration | Exploiting platform glitches, price feed errors |

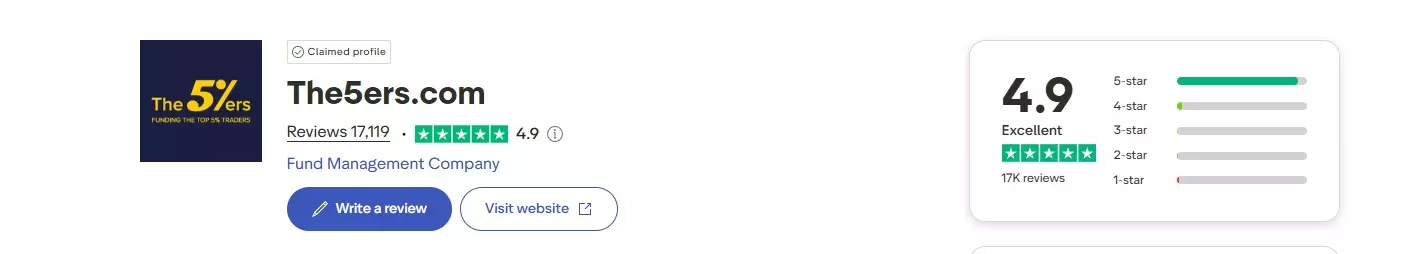

Is The5ers Legit? Trustpilot Ratings & Global Trader Feedback

For traders considering a proprietary trading firm, credibility and transparency are critical. In this The5ers Prop Firm Review 2025, one of the most frequently asked questions is: “Is The5ers a legit prop firm?” The answer is yes — The5ers is widely recognized as one of the most reputable forex prop trading firms worldwide.

Instead of relying only on marketing, thousands of traders across different regions openly share their experiences through trading communities, online forums, and social media. Discussions often cover payout reliability, customer support, and trading conditions — reinforcing the company’s image as a transparent and trusted prop firm.

According to Trustpilot, The5ers has earned more than 17,000 verified reviews with an outstanding average rating of 4.9 out of 5 stars. The vast majority of traders rate their experience as “Excellent,” highlighting fast and reliable payouts, responsive support, and fair evaluation rules. These results clearly show why The5ers is considered a leading choice among global prop trading firms.

Pros & Cons of The5ers Prop Firm

In this The5ers Prop Firm Review 2025, it’s important to highlight both the strengths and weaknesses of the company. Like any prop trading firm, The5ers has unique advantages that attract traders, as well as certain limitations that traders should consider before joining.

✅ Pros

- Excellent Trustpilot rating of 4.9/5 with 17K+ reviews.

- Flexible funding options from $20K up to $250K.

- Up to 100% profit split depending on program.

- Unlimited time to complete challenges.

- Clear scaling plan to grow trading accounts.

- Strong international trader community.

- Reliable and fast payouts with professional support.

❌ Cons

- Initial evaluation fee required to join.

- Restricted in certain countries*.

- Strict risk management rules can be challenging.

- Payout schedules may vary by program.

- Some traders prefer firms with instant funding models.

* Restricted countries include: Afghanistan, Burundi, Central African Republic, Cuba, Congo Republic, Crimea, Democratic Republic of Congo, Eritrea, Guinea, Guinea-Bissau, Iraq, Iran, Israel, Laos, Lebanon, Liberia, Libya, Myanmar, North Korea, Palestinian Territory, Papua New Guinea, South Sudan, Sudan, Somalia, Syria, Vanuatu, Venezuela, Yemen.

Final Verdict: Should You Join The5ers in 2025?

After analyzing this The5ers Prop Firm Review 2025, it’s clear that The5ers has built a solid reputation in the proprietary trading industry. With excellent Trustpilot ratings, transparent funding rules, and programs that scale traders up to $250K with profit splits up to 100%, the firm provides a credible pathway for skilled traders seeking external capital.

On the downside, strict risk management rules, upfront evaluation fees, and country restrictions may discourage some traders. The absence of instant funding for every program means The5ers may not suit those who prefer rapid access to capital without evaluations.

- Best suited for: Traders who value discipline, risk control, and long-term growth.

- May not be ideal for: Traders looking for instant funding, high leverage without restrictions, or those unwilling to follow strict rules.

Overall, The5ers remains one of the most trusted forex prop firms in 2025. If you are confident in your strategy, willing to follow rules, and want a partner that rewards consistency, The5ers is worth considering. However, always review the official guidelines to ensure the firm’s programs align with your trading style and goals.

Frequently Asked Questions

Is The5ers a legit prop firm?

Yes, The5ers is considered a legitimate prop trading firm. Founded in 2016, it is highly rated on Trustpilot (4.9/5 from 17,000+ reviews) and trusted by traders worldwide.

How much funding can I get with The5ers in 2025?

Depending on the program, traders can scale up to $250,000 in trading capital, with profit splits of up to 100%.

Does The5ers allow news trading?

Yes, but with restrictions. In Bootcamp and Hyper-Growth, news trading is allowed except for bracket orders. In the High Stakes program, trading is restricted 2 minutes before and after high-impact news.

Can I use Expert Advisors (EAs) with The5ers?

Yes, EAs are allowed as long as they follow the rules. Each trade must include a Stop Loss, and strategies such as tick scalping, arbitrage, or emulators are not permitted.

What are the cons of The5ers?

Some drawbacks include strict risk management rules, initial evaluation fees, restricted access in certain countries, and no instant funding in most programs.

Which countries are restricted by The5ers?

Restricted countries include Afghanistan, Iran, North Korea, Syria, Venezuela, and others. Always check the official website for the latest updated list.