FxPro Review 2025: A Deep Look Into Regulation, Trading Experience, and Real Broker Credibility

In the crowded world of Forex and CFD trading, “trust” isn’t just a marketing slogan — it’s what separates a real broker from a risky one.

FxPro has been around for nearly two decades, often praised for its execution speed, transparency, and professional service.

But does it really live up to the hype?

This 2025 FxPro review takes an honest look at the broker’s performance, regulation, trading conditions, and user experience — based on verified data and real trading tests.

1. Company Overview: Over 20 Years of Global Presence

Established Legacy and Global Reach

Founded in 2006 and headquartered in London, United Kingdom, FxPro has grown to become one of the most established and respected global brokers in Forex and CFD trading.

According to fxpro.com,, the company serves over 11.2 million client accounts in more than 170 countries and has received more than 130 international awards for its excellence in trading technology, transparency, and customer service.

Some notable recognitions include:

- Best FX Service Provider by Global Brands Magazine

- Best Trading Platform by World Finance

- Best Forex Broker by Financial Times Investors Chronicle Awards

These accolades reflect FxPro’s consistent reputation for innovation, reliability, and client satisfaction in the global financial market.

Broad Range of Trading Instruments

FxPro provides access to over 2,100 CFD instruments, giving traders a comprehensive and diversified portfolio of investment opportunities. These include:

- Forex: More than 70 major, minor, and exotic currency pairs.

- Indices: Global indices such as S&P 500, NASDAQ 100, FTSE 100, DAX 40, and others.

- Commodities and Metals: Including gold, silver, oil, and natural gas.

- Stock CFDs: Shares of leading global companies like Apple, Amazon, Tesla, and Google.

- ETFs and Cryptocurrencies: A growing selection of ETF CFDs and popular digital assets such as Bitcoin and Ethereum.

Availability of specific instruments may vary depending on the trader’s jurisdiction and account type.

Technology & Trading Model

FxPro’s competitive edge lies in its No Dealing Desk (NDD) execution model, which ensures fast, fair and transparent trade execution — all orders are processed direct via liquidity providers, without dealer intervention.

This model delivers:

- Ultra-fast execution speeds — most orders are executed in under 11 milliseconds.

- No requotes or hidden mark-ups, providing transparency and accurate pricing.

- No conflict of interest, since FxPro states it does not take positions against its clients.

Such features make FxPro a strong choice for professional traders, algorithmic strategies, and investors looking for a reliable and neutral trading environment.

Innovation & Global Development

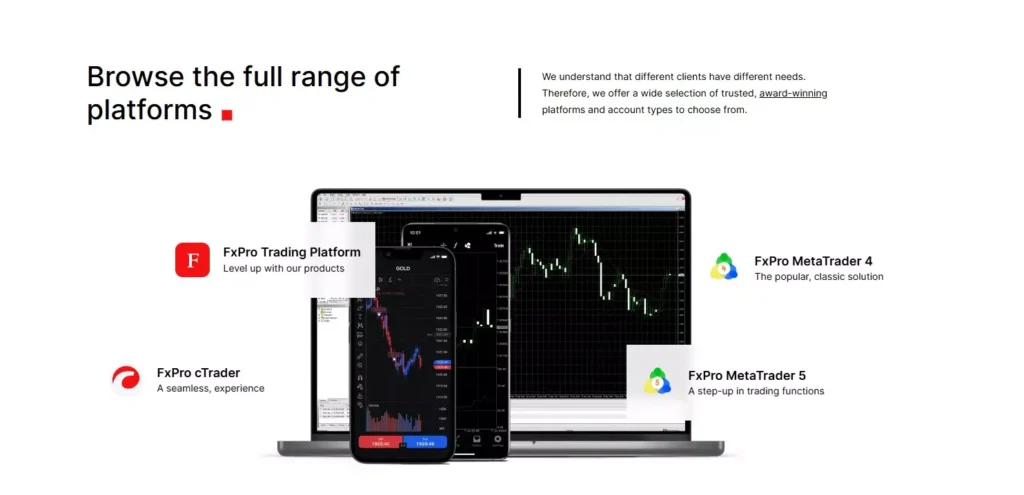

Beyond its core brokerage services, FxPro continually invests in advanced trading technologies and trader education. It has developed its proprietary web-based FxPro Edge platform and offers clients access to multiple platforms including MetaTrader 4, MetaTrader 5 and cTrader.

The company also offers educational resources such as online courses, tutorials and market-analysis content, designed to support traders at various experience levels.

Guided by its principle “Trade Responsibly”, FxPro maintains a commitment to providing a secure, transparent and sustainable trading environment—with the flexibility to serve traders in over 170 countries.

Note: Product availability, features and services may vary depending on your jurisdiction and the local regulatory framework.

2. Regulation & Trustworthiness

Is FxPro Legit and Regulated?

When discussing the legitimacy of FxPro, regulation plays a defining role. FxPro is widely recognized as a legit and fully licensed broker, operating under multiple top-tier financial authorities. This ensures full compliance, transparency, and protection for all clients worldwide — a core factor often highlighted in every FxPro review 2025.

Global Regulatory Oversight

FxPro holds several international trading licenses, confirming its strong regulatory standing:

- FCA (United Kingdom): Tier-1 regulator ensuring strict client fund protection.

- CySEC (Cyprus): Oversees European operations under MiFID II standards.

- SCB (Bahamas): Regulates international clients, providing global coverage.

- FSCA (South Africa): Ensures compliance for the African region.

This multi-jurisdictional regulation makes FxPro one of the most trusted brokers in the global trading industry.

Verified Trust and Transparency

According to ForexBrokers.com (2025), FxPro achieved a Trust Score of 93/99, ranking as a “Highly Trusted” broker — on par with leading financial brands. Independent ratings consistently confirm that FxPro is legit, transparent, and financially stable.

FxPro Regulation and Client Protection

FxPro’s regulatory framework ensures complete client safety:

- Segregated funds kept in top-tier banks.

- Negative balance protection for all accounts.

- Full compliance with MiFID II and ESMA transparency standards.

These protections mean clients never face hidden risks — a key advantage often mentioned in FxPro pros and cons comparisons.

Bottom Line

FxPro stands out as a highly regulated, legitimate broker with a proven record of trustworthiness. Its strong global regulation, client protection measures, and long-term transparency make it a top contender in most FxPro review 2025 analyses.

3. Trading Platforms & Technology

FxPro supports a range of industry-leading trading platforms suitable for all experience levels:

| Platform | Key Features |

|---|---|

| MetaTrader 4 (MT4) | User-friendly interface, supports Expert Advisors (EAs), and over 50 technical indicators. |

| MetaTrader 5 (MT5) | Advanced order types, market depth, and enhanced charting capabilities. |

| cTrader | Designed for professionals — ultra-fast execution, Depth of Market (DOM), and algorithmic trading tools. |

| FxPro Edge | Proprietary web & mobile platform with modern design and seamless account management. |

According to Investing.com, FxPro’s average execution speed is around 13 milliseconds, with no requotes.

The broker also supports API trading, copy trading, and automated strategies — making it suitable for both manual and algo traders.

🎯 Highlight: All FxPro platforms deliver stable performance and fast execution even under high market volatility.

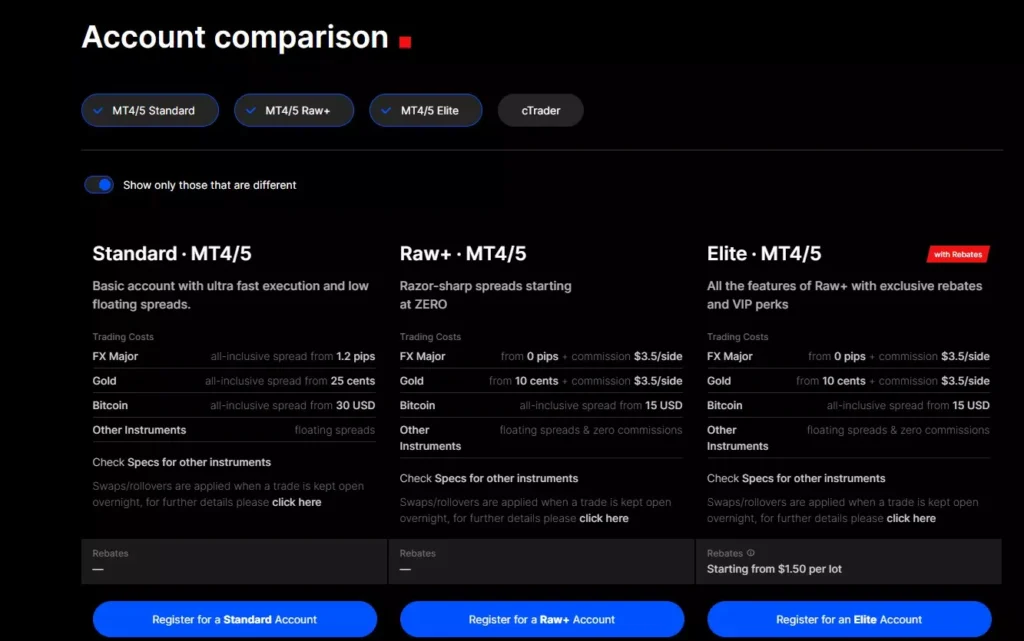

4. Account Types & Trading Costs

FxPro offers several account types designed to suit different trading styles and experience levels.

| Account Type | Main Features |

|---|---|

| Standard (MT4/MT5) | No commission, spreads from 1.2 pips — ideal for casual traders. |

| Raw+ (MT4/MT5) | Spreads from 0 pips + $3.5 per lot per side commission. |

| Elite (MT4/MT5) | All features of Raw+ with exclusive rebates and VIP perks. |

| cTrader | Ultra-low spreads with a $35 per $1 million traded commission on FX & Metals. |

Fees & Conditions:

- Competitive spreads, especially on Raw+ and Elite accounts

- No deposit or withdrawal fees (except rare refund cases)

- Inactivity fee applies after 6 months of no trading activity

According to BrokerChooser, FxPro’s pricing is “reasonable and transparent” — not the cheapest, but consistent with high-quality brokerage service.

If you’d like to see how FxPro compares with other brokers such as IC Markets and Pepperstone, check out our detailed comparison here.

5. Customer Support & Real User Feedback

In this FxPro review 2025, user feedback highlights the broker’s strong reputation for reliable customer service and transparent operations.

On Reviews.io, FxPro holds a solid rating of 4.21 / 5 from over 870 verified users, with about 60% rating the broker 5 stars. Traders often mention smooth withdrawals, responsive multilingual support, and a user-friendly experience through the FxPro Direct App and FxPro Edge platform.

Positive feedback includes:

- Fast withdrawals (typically processed within 1–2 business days)

- 24/5 multilingual customer support (including Vietnamese)

- Easy account management via the FxPro Direct App

According to FxLeaders (2025):

“FxPro remains one of the most stable and trustworthy brokers in the market — ideal for professional traders who value speed and reliability.”

While FxPro is widely regarded as legit and dependable, some users note minor drawbacks such as slippage during high volatility and limited educational materials for beginners.

Overall, FxPro continues to earn positive recognition for its fast execution, reliability, and client-focused support — key strengths that make it one of the better-rated brokers in 2025.

6. FxPro Pros and Cons

Before determining whether FxPro is legit and suitable for your trading goals, it is important to understand its key strengths and weaknesses. Based on the latest FxPro review 2025, the broker maintains a strong reputation for regulation, transparency, and trading innovation. However, as with any global brokerage, there are a few areas that can be improved.

✅ Pros

Strong Global Regulation

FxPro is regulated by four top-tier authorities — the FCA (UK), CySEC (Cyprus), SCB (Bahamas), and FSCA (South Africa). This broad regulatory framework ensures compliance with international standards and confirms that FxPro is a fully legit and trustworthy broker.

Excellent Trust Rating

According to independent financial assessments, FxPro holds a Trust Score of 93/99, ranking it among the highest-rated brokers worldwide. This reinforces its reputation for security and reliability in the 2025 global trading market.

Professional-Grade Trading Platforms

FxPro provides access to MetaTrader 4, MetaTrader 5, cTrader, and FxPro Edge, offering professional-grade execution speed, customizable tools, and advanced analytics. These platforms cater to both beginners and experienced traders seeking a smooth trading experience.

Transparent Fees and Fair Conditions

FxPro charges no deposit or withdrawal fees in most cases and includes Negative Balance Protection for all clients. The No Dealing Desk (NDD) model ensures neutral execution with no conflict of interest between the broker and its traders.

Reliable Performance and Speed

With trade execution speeds averaging under 13 milliseconds, FxPro offers fast, stable, and reliable order processing, suitable for algorithmic and high-frequency traders who value precision.

⚠️ Cons

Inactivity Fee

An inactivity fee is charged after six months of no trading activity, which may affect traders who prefer a passive or occasional trading style.

Limited Educational Materials for Beginners

While FxPro offers a knowledge base and webinars, the learning resources are relatively limited compared to other large brokers with dedicated educational academies.

Slightly Higher Spreads on Standard Accounts

The spreads on standard accounts are sometimes higher than those offered by ECN brokers, particularly during high market volatility.

Occasional Slippage During News Events

Although order execution is usually consistent, minor slippage can occur during major financial news releases — a common occurrence in fast-moving markets.

Bottom Line: Is FxPro Legit and Worth It?

Based on this in-depth FxPro review 2025, FxPro stands out as a regulated, legitimate, and highly reliable broker offering advanced platforms and robust client protection. It is a strong choice for traders who prioritize safety, transparency, and global regulation.

While minor drawbacks exist, such as inactivity fees and limited educational resources, the overall advantages — including regulation, execution quality, and platform variety — clearly outweigh the negatives. FxPro continues to be one of the most trusted and well-regulated brokers for 2025.

7. Who Is FxPro Best For?

Ideal For

Based on this FxPro review 2025, the broker is particularly well-suited for experienced and professional traders who value reliability, speed, and regulatory protection. FxPro’s multi-jurisdictional regulation and institutional-grade infrastructure make it a strong choice for investors seeking a legitimate, transparent, and globally trusted platform.

- Experienced or professional traders looking for advanced trading tools, analytical depth, and multi-account management.

- Day traders and scalpers who need low-latency execution and ultra-fast order processing — FxPro’s average execution time of under 13 milliseconds provides a major edge.

- Investors who prioritize regulation and transparency over ultra-low spreads. With top-tier licenses from the FCA, CySEC, SCB, and FSCA, FxPro offers a trading environment that prioritizes safety and compliance.

- Multi-asset traders who appreciate flexibility across multiple platforms, including MetaTrader 4, MetaTrader 5, cTrader, and FxPro Edge. This diversity allows users to tailor their trading experience to personal strategy and style.

- Algorithmic and API traders who benefit from FxPro’s robust connectivity and stable infrastructure, ensuring minimal downtime even in volatile markets.

FxPro’s regulatory standing and consistent trust ratings reinforce that FxPro is legit and ideal for traders who demand both speed and accountability in a single brokerage.

Less Suitable For

While FxPro offers advanced technology and regulation-driven security, it may not suit everyone. Some traders — particularly beginners — may find its professional setup challenging without prior experience.

- Complete beginners seeking step-by-step education or guided training may find FxPro’s learning resources less comprehensive than beginner-focused brokers.

- Infrequent traders, as FxPro applies an inactivity fee after six months without trading activity.

- Traders prioritizing ultra-low spreads without commissions may find the standard account spreads slightly higher compared to pure ECN competitors.

- Casual investors who prefer passive or copy-trading models might find FxPro’s self-directed structure less aligned with their needs.

Summary

Overall, FxPro is best suited for serious, regulation-conscious traders who appreciate precision execution and professional-grade tools. For those comparing FxPro pros and cons, the broker’s trustworthiness, regulatory coverage, and platform versatility strongly outweigh its few drawbacks.

As confirmed in this FxPro review 2025, the company continues to rank among the most legitimate and reliable brokers, offering a secure environment for active traders across the globe.

8. Final Verdict: Is FxPro Still Worth It in 2025?

After reviewing its regulation, platforms, trading conditions, and real user feedback, FxPro remains one of the most reliable global brokers in 2025.

Its FCA regulation, fast execution, and transparent pricing make it a strong choice for traders who value security and stability over gimmicks.

✅ Verdict: FxPro isn’t perfect — but it’s undeniably one of the most trusted and professionally managed brokers you can trade with in 2025.

FxPro FAQ – Common Questions (2025 Update)

1. Is FxPro regulated and legitimate?

Yes — FxPro is a fully regulated broker supervised by top-tier authorities including the Financial Conduct Authority (UK) and the Securities Commission of The Bahamas, ensuring client fund protection and transparency.

2. How many tradable instruments does FxPro offer?

FxPro gives access to over 2,100 CFD instruments across forex, indices, commodities, stocks, ETFs, and cryptocurrencies (availability may vary by region).

3. What trading platforms are available with FxPro?

FxPro supports MetaTrader 4, MetaTrader 5, cTrader, and its own web-based platform FxPro Edge.

4. What is the minimum deposit to open an account?

The minimum deposit is typically $100, depending on the account type and jurisdiction.

5. Does FxPro charge fees for deposits and withdrawals?

No — FxPro does not charge deposit or withdrawal fees for most payment methods, though external provider fees may apply.

6. Are deposits safe and where are client funds held?

Client funds are kept in segregated accounts with top-tier banks, and FxPro provides Negative Balance Protection.

7. What leverage does FxPro offer?

Leverage depends on regulation: under FCA (UK) rules it’s limited to 1:30, while international entities may offer higher leverage options.

8. Is FxPro beginner-friendly?

FxPro offers learning materials, webinars, and market analysis, but some reviews note its educational content is limited compared to larger brokers.

9. Is FxPro suitable for algorithmic or professional traders?

Yes — platforms like cTrader and MT5 support algorithmic and API trading, making FxPro ideal for professional traders.

10. What are FxPro’s drawbacks?

Some users mention slightly higher spreads on Standard accounts, limited educational materials for beginners, and an inactivity fee after six months.